Forex scalping trading indicators remain important even in the days of high-frequency trading and dark pools. Scalpers profit from small market movements in the high ground thanks to a ticker tape that never stands still. This fast-fingered day trading crowd depended on level 2 bid/ask screens to situate buy and sell signals. They read demand and supply imbalances away from the National Best Bid and Offer (NBBO), the bid/ask price before the average investor.

Buying when technical conditions push the asking price lower than lower, scalpers sell when technical conditions push the bid price higher than normal, booking a profit or loss within minutes, just as balanced conditions come back to the spread.

Scalpers set out to deal with the challenges of the electronic market with indicators custom-tuned for short-term opportunities. These real-time tools use signals akin to those used for longer-term strategies. However, they are applied to two-minute charts.

These forex scalping trading indicators give the best outcome when strongly trending or strongly range-bound action controls the intra-day tape. They do not work so well while periods of confusion/conflict are ongoing. The conditions are in place at times when you are being whipsawed into losses at a greater pace than is generally present on your run-of-the-mill profit-and-loss curve.

Moving average ribbon entry strategy: forex scalping trading indicators

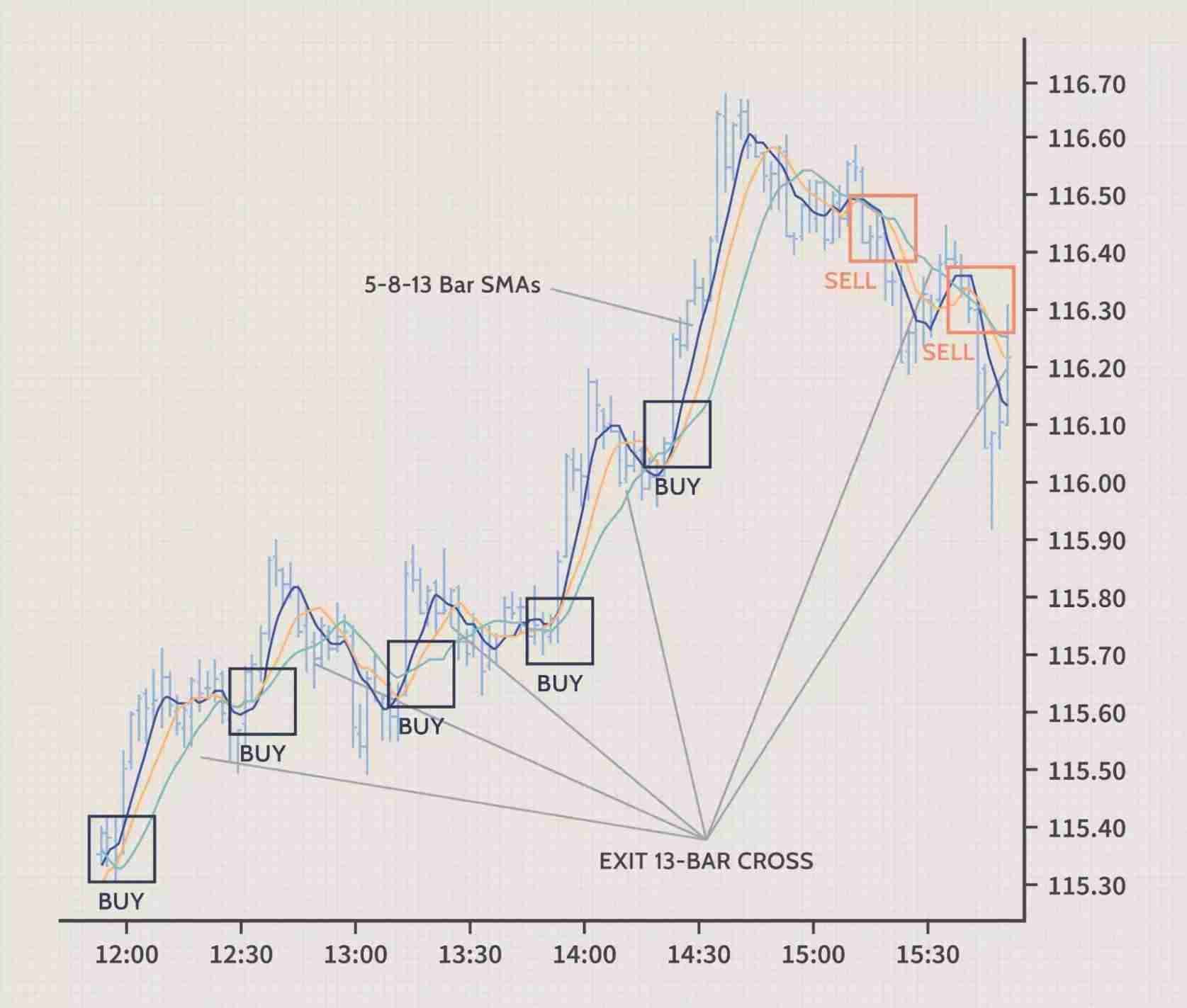

Placing a 5-8-13 simple moving average combination on the two-minute chart identifying strong trends that may be bought/sold on counter swings, in addition to being warned of trend changes in the offing, is what the strategy is concerned with.

The 5-8-13 ribbon will align, facing higher or lower, during strong trends that keep prices to the 5 or 8 bar SMA.

13 bar SMA penetrations imply waning momentum preferring a range or reversal. During range swings, the ribbon flattens out. The price may crisscross the ribbon oftentimes. The scalper then looks out for realignment. The ribbons turn higher/lower, spreading out and showing more space between the lines. This little pattern triggers the sell or buy short signal.

Relative strength/weakness exit strategy: the best indicator for scalping

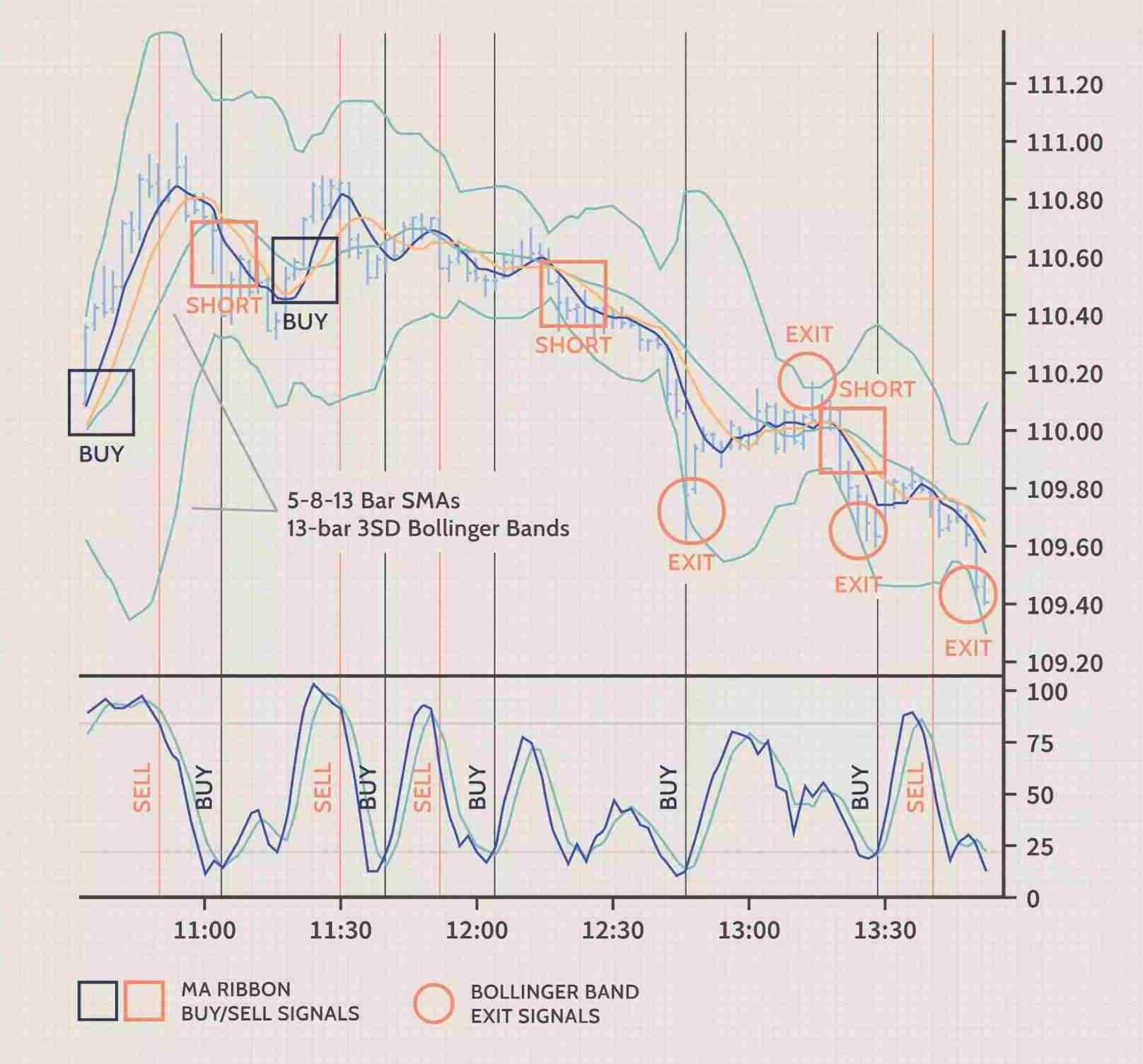

How does the scalper get the cue as to when to take profits or cut losses. 5-3-3 Stochastics and a 13 bar, 3 standard deviations Bollinger Band, among best forex scalping trading indicators, used along with ribbon signals on two-minute charts give good outcomes in actively traded markets. These include Dow components, index funds, and other widely-held issues such as Apple Ins.

When Stochastics becomes high from the oversold level or lowers from the or lower from the overbought level, The best ribbon trades are set up. Similarly, following a profitable thrust, an immediate exit is needed when the indicator crosses and rolls against your position.

By observing band interaction with price, you may time that exit with greater precision. They forecast that the trend will slow/reverse, so it makes sense to take profit into band penetrations.

Scalping strategies cannot just remain thru retracements. Take the cue and that timely exit in case a price thrust fails to reach the band. The Stochastics rolling over tells you to flee.

At a later stage, when you are familiar with the workflow and the synergies, you would do best to adjust standard deviation higher to 4SD or lower to 2SD to yield the reason behind daily volatility fluctuations.

You could also grab a wider variety of signals just by superimposing the additional bands over your current chart.

Multiple chart scalping: forex scalping trading indicators

Pull up a 15-minute chart without forex scalping trading indicators, keeping in the know of background circumstances impacting your intraday performance. Add three lines. One is for the opening print, two for the trading range high/low set up in the session’s first 45-90 minutes. Look out for price action at those levels, given that they will set up larger-scale two-minute buy/sale signals.

As a matter of fact, you will find that when scalps align with support and resistance levels on the 15 minute, 60 minute, or daily charts, your greatest trading day profits come.

Parabolic stop & reverse: forex scalping trading indicators

The parabolic SAR, or the parabolic stop and reverse, is a trend following indicator. You may see it as a single parabolic line below the uptrend price bars and above downtrend price bars.

The parabolic SAR has three main functions:

- It highlights the ongoing price direction or trend.

- It offers potential; entry signals.

- It offers potential exit signals.

Parabolic SAR calculation

The PSAR indicator makes use of the most recent extreme price (EP), besides an acceleration factor (AF)to decide where the indicator dots will appear

The PSAR is reckoned as hereunder:

Uptrend PSAR: PSAR = prior PSAR + prior AF (prior EP – prior PSAR)

Downtrend: PSAR = Prior PSAR – Prior AF (Prior PSAR – Prior EP)

Where –

AF = 0.02 default, increasing by 0.02 each time a new EP is realized, with the maximum of 0.20.

EP = highest high for an uptrend, lowest low of a downtrend, updated each time a new EP is realized.

The calculation creates a dot below the rising price action, or above the falling price action. Thus, the dots assist in highlighting the ongoing price direction. Always present, the dots cause the indicator to be called a stop and reverse.

The dots flip on price bars’ top. The dots flip below the price below when the price rallies thru falling dots.

Parabolic SAR – forex scalping trading indicators

Parabolic SAR’s basic use is to buy when the dots move below the price bars, showing an uptrend. It also sells or short sells with the dots moving above the price bars, showing a downtrend.

Consequently, there will be continual trade signals. The trader will always have the position. If the price is making big swings back and forth, offering a profit at each trade, that can be good.

The continual trade signals may produce losing trades in a row, the price is only making small movements in each direction.

Hence, it is better to analyze the day’s price action to decide if there is a trend moving up or down.

Moving average, or trendline, another indicator may set up the general trend direction. In case there’s a trend, just take trade signals in the general trend direction. For instance, when the trend is down, just take short trade signals. When the dots flip on price bars’ top, then exits when the dots flip below the price bars, you take such trade signals.

The indicator is thereby used for its main element – getting hold of trending moves. Capixal steers you out of challenging positions with smart risk management strategies.

Parabolic SAR: forex scalping trading indicators’ pro & con

Pro

The indicator’s main advantage is that whilst there’s a strong trend, the indicator will highlight it, keeping the trader in the move. There’s an exit when there’s a move against the trend, signalling a reversal. Sometimes the exit is good so that the price reverses. However, when the price begins to move immediately, the exit is anything but great in the trending direction.

Con

The indicator’s main demerit is that it offers little analytical insight or good trading signals during sideways market conditions. The forex scalping trading indicator continually flips flops above and below the price, given no clear trend.

Recommended

Learn to identify the trend. Read price action or take the help of another indicator. Traders must avoid trades when a trend is not present.

Stochastic oscillator indicator: forex scalping trading indicators

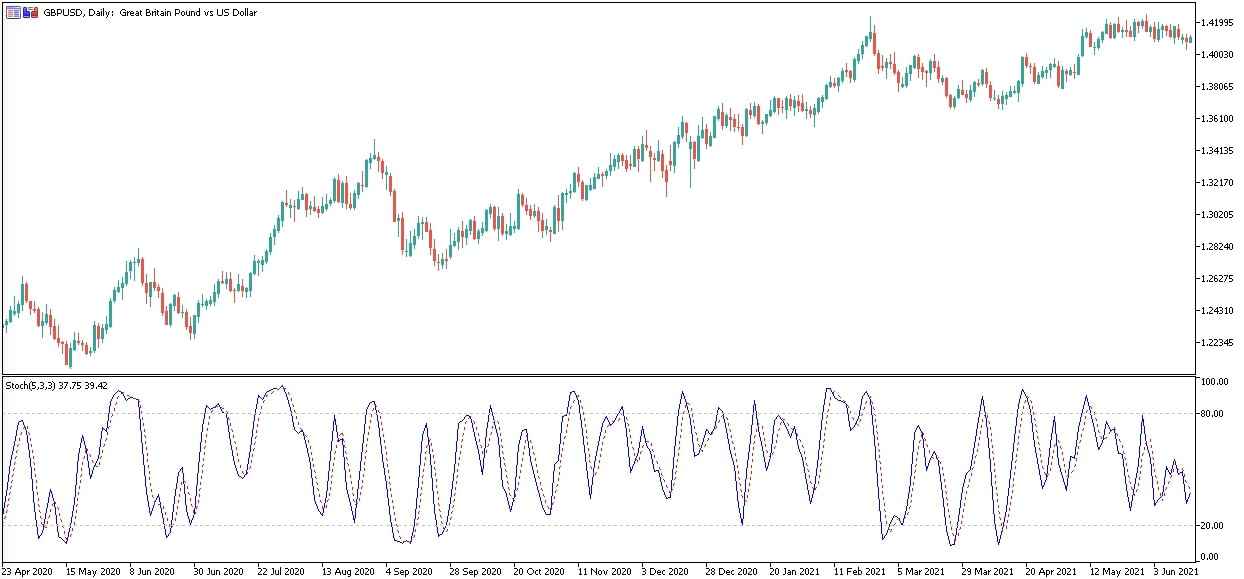

A stochastic oscillator’s momentum indicator compares a particular asset closing price to a high low range over a given number of periods. The indicator’s basic premise is that momentum comes before price. Hence, the stochastic oscillator could signal an actual movement prior to it taking place.

The Stochastic, range-bound oscillator runs, by default, between 0 and 100. The indicator itself shows the %K line and a moving average of %K also called %D.

The stochastic indicator looks like when applied to a price chart with the default settings:

The stochastic indicator formula

The %K and %D lines of the stochastic indicator are calculated per formula

%K = 100[(C-l14)/(H14 – L14)]

WHERE

C is the ongoing closing price

L14 is the lowest price when looking back at 14 preceding sessions

H14 is the highest price when looking back at 14 preceding sessions

%K tracks the most current forex pair market rate

%D = % K’ 3-period simple moving average

Stochastic Divergence

Making sense of stochastic divergence is important since it can signal a trend reversal.

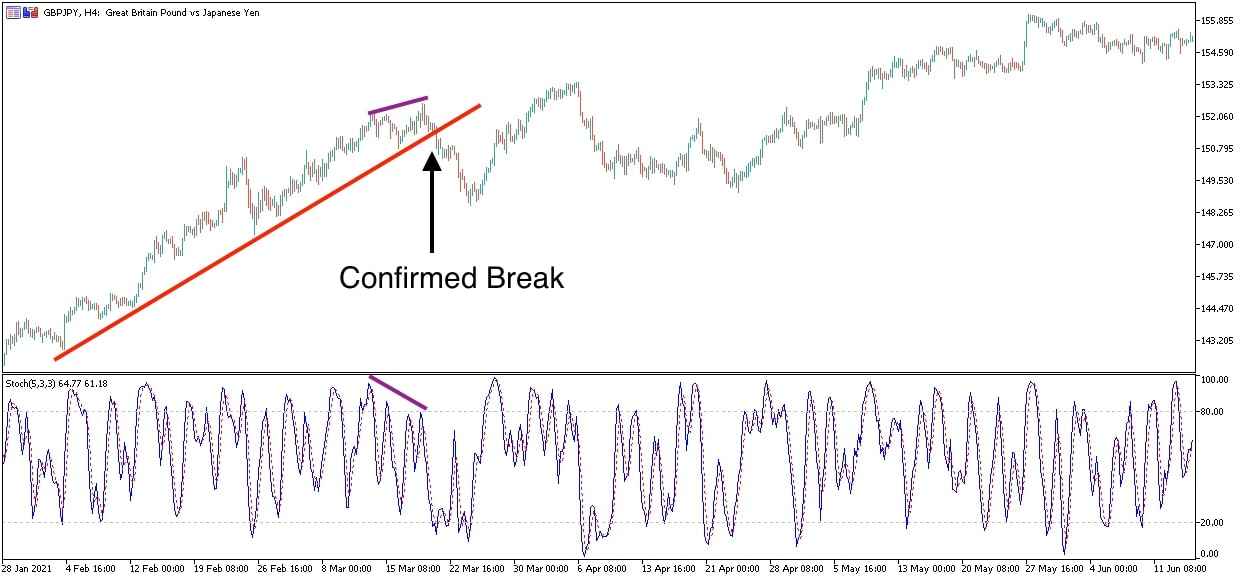

We have a bullish divergence, when the price is making a lower low, the stochastic making a higher low.

We have a bearish divergence if the price is making a higher high, but the stochastic is making a lower high.

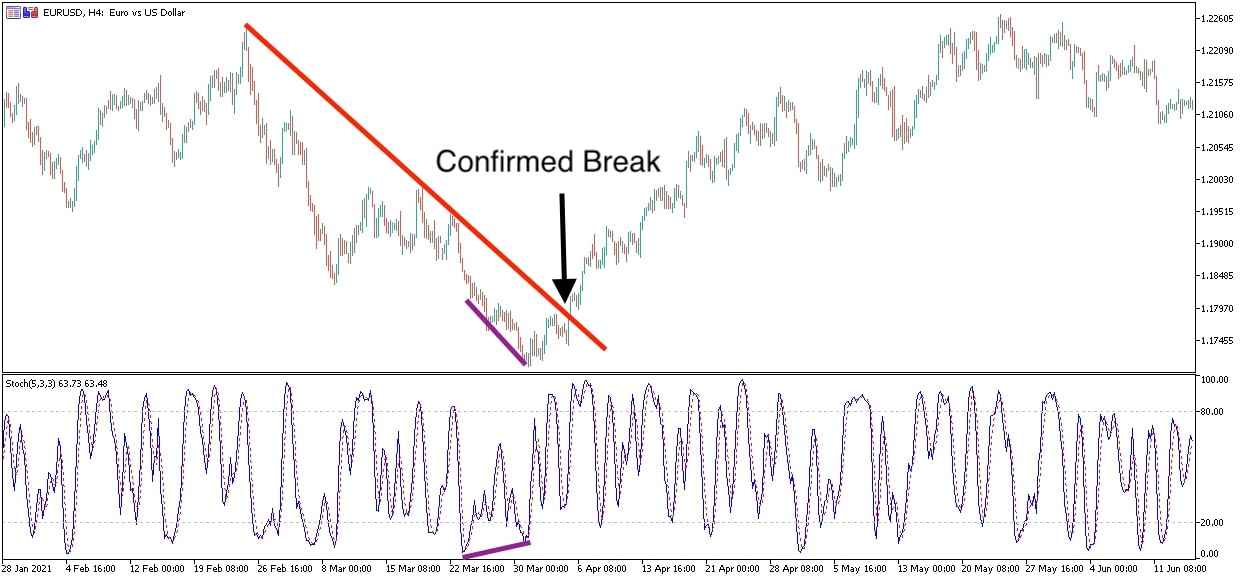

Divergence will always take place post a sharp price movement higher and lower. A cue that the price might reverse, divergence is generally confirmed by a trend line break.

Bullish divergence with confirmed trend line breakout

Bearish divergence with a trend line breakout

Breakout trading: forex scalping trading indicators

You find breakout trading when prices stay in a consolidation prior to snapping out of the range. But, again, a strong momentum leads the breakout.

With trading breakout methods, you just have to identify the potential breakout. You may witness this when price action moves in a sharp oblique range. Then, the sideways movement extended period leads to a strong breakout.

The Bollinger band indicator is great at demarcation periods of high and low volatility.

Price action is also similarly used to identify the price range and determine which way the price would break out.

Volatility breakout: forex scalping trading indicators

Volatility breakout is akin to breakout trading in some ways. However, the concentration is on volatility observation itself. Volatility breakout can be treated with better insight, thanks to oscillators.

You can have a better understanding of price action relative to signals from forex scalping trading indicators.

News based trading: forex scalping trading indicators

Trading on fundamentals is the approach traders take to use volatility. The scalper has to have some in-depth understanding of fundamentals and the technical. He has to be able to make sense of the way the markets will react to the news.

News-based trading frequently leads to the risk of widening spreads. You can observe this if you look out for variable spreads. Deviating bid and ask prices can easily trigger your stops. Like price action trading, this and similar forex scalping trading indicators require a subjective approach.

Conclusion

There are a good number of forex scalping trading indicators waiting to be used for optimal profits. First, open a demo trading account with Capixal to get familiar with the intricacies involved.

Some scalping strategies are easy to see in hindsight but challenging to trade in real-time. With breakouts, it can happen that you may have to engage in trades many times before you capture the one move that matters.

A scalper’s focus implies that he is able to spot changes in the middle of fluctuations straight away. The longer the position is held, the more there is the risk of prices moving outside his betting range. Experience helps the scalper in making better use of forex scalping trading indicators.