Short selling is one way to make money on stocks for which the price is plunging. The strategy has become increasingly popular in short time.

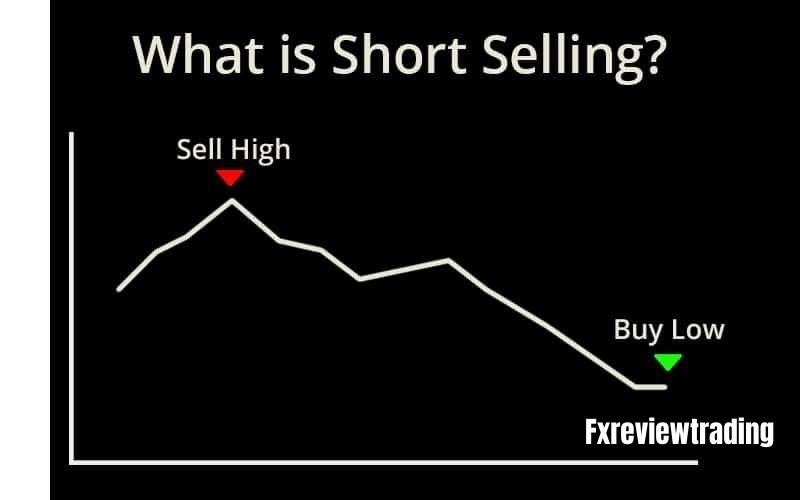

Unlike holding long positions, short sellers borrow shares, sells them, and subsequently purchase them back, returning them to the lender and earn profits.

But it’s totally different from bank loans, in which you borrow money. In case, if there is a limited supply of shares for short sell, it is referred to as hard to borrow.

However, it is an advanced investment strategy that only seasoned investors and traders ought to use in the real world. Short sellers are willing to bet that the stock they are short selling will plummet in terms of price.

In case the stock does plunge after selling, the short seller buys it back at a lower price, giving it back to the lender.

On the other hand, regulators like the Securities and Exchange Commission (SEC) have the right to restrict who can short sell and when investors can short sell. The short seller’s profit is the difference between the sell and buy prices.

Read this article till the end to understand the term better. Let’s discuss about it!

Short Selling: Why do it at all?

Generally, you would short stock since you hold a stock price that is set downwards. However, given you sell short stock today, you will be able to repurchase it at a lower future price.

In case this investment strategy works, you may make a decent profit by keeping the profit between the price when you sell and the price when you buy. You might still end up with the same amount of stock of the same stock you had initially.

Some traders are speculators and do short selling for that purpose. Others would like to hedge or shield their downside risk if they have a long position.

Short Selling: How it Works?

Generally, Short stock involves borrowing shares and not owning them. Simply, you don’t buy shares, you just borrow them. There are several advantages of this strategy.

For instance, in case client think a stock price is overvalued, they may determine to borrow 10 ABC stock shares from your broker.

Then, in case you sell these borrowed shares at $50 each, you can keep $500 in cash. Simultaneously, however, you will have to purchase and return the 10 shares of stock to your broker.

In the event of the stock falls to $25 per share, you may purchased the 10 shares again for a mere $250. The total profit would be $250. That is, the $500 profit made first, less the $250 you spend to purchase the same number of shares back.

But in case the price of the stocks rise beyond the $50 price, money is lost. So to buy back the borrowed shares and give them back into the brokerage account, you will have to pay a higher price.

For instance, were the stock to go to $250 per share, you would have to spend $2500 to repurchase the 10 shares you’d owe the brokerage firm.

So the net loss would amount to $2000, although you’d be keeping the original $500. If you want to sell stock short, do not think about repurchasing it. Notably, calculating profit for a short sale is more contrived. You’d pay a minor commission.

For the trade, extracted from your returns. Contingent upon timing, you might have to pay dividends to your shares’ buyer. Avoid panic and get the timing right, with InvestBy!

Short Sale Instance:

For instance, take an investor who thinks that at $325 per share, Meta, of ‘Facebook’ fame, is grossly overvalued and is sure to plummet value-wise.

In that scenario, the investor could ‘borrow’ ten Meta shares from their broker, subsequently selling the shares for the current market price ($325).

Then, if the price plunges to $250, the investor could purchase ten shares back at this value and return the borrowed shares to the broker, making $750.

Nonetheless, in case Meta’s share prices appreciate to $375, the investor would unhand $500.

Risk of Short Selling:

Short selling magnifies risk considerably. For example, when retail investors purchase one FB share at $325, the maximum they could lose would be $325. The stock, after all, cannot palmetto less than $0.

Nonetheless, when investors short sell, they may theoretically unhand an infinite amount of money. A stock’s price can keep appreciating forever.

As in the instance above, in case an investor had a short position in Meta or had short sold it, and the price appreciated to $500 prior to the investor exiting, they would be poorer by $175 per share.

Additionally, another risk that short sellers face is that of short squeezes. This would concern a stock with a large short interest – that is, a stock that has been heavily sold short – appreciates swiftly in share prices.

This precipitates a steeper price ascent in the stock as more and more short sellers purchase back the stock to offsetting short positions, capping their potential losses. Many brokers often charge platform fees for selling short.

Is Short Selling Dangerous?

When you short a stock, you expose yourself to a large financial risk. A notable instance of loss owing to sorting a stock is the Northern Pacific Corner, 1901. Northern Pacific Railroad touched $1000.

A few ultra-rich Americans went bankrupt as they tried to buy back the same number of shares, returning them to lender. If you are planning to sells short stock, do not believe that you’d be able to repurchase it at a price you like, whenever it fancies you.

When investing, you ought never to assume that, for a stock to go from price A to price C, it has to go through price B.

There has to be a market for a certain stock. There may be a chance of huge losses if no one is selling said stock; there are too many buyers, and many short sellers are attempting to close out their positions.

Short Squeeze: Short Selling

Due to the Short squeeze, many short sellers cut their losses by buying shares again before prices increased even more.

Early this year, Wall Street Bets followers from Reddit came together to lead to a massive short squeeze in stocks of wobbly companies with very high short interest, an instance being GameStop, the video games retailer.

This facilitated the company’s share price rises by 17 times, six times in January itself. Usually, selling short may only be undertaken in a margin account, a type of account by which most brokers lend funds to traders and investors to trade securities.

Hence, the short seller has to surveil the margin account with precision to guarantee that the account always has enough capital or margin to maintain the short position.

In case the stock that the trader has sold short abruptly spikes in price, the trader will be compelled to pump more funds into the margin account straight away or you might be issued a margin call by your broker.

Conversely, if a trader fails to meet the margin call, the brokerage firm may close all open positions to bring your account back to the minimum requirement, saddling the trader with the loss.

However, margin accounts do not apply to fund managers who hedge their long position against any downside risk.

It’s worth noting that in the event of an investor shorting stock, there is technically no limit to the amount you lose since the stock may keep on appreciating indefinitely.

So in a handful of cases, investors can end up owing their broker, dealer money in every likelihood.

The Compulsion behind Short Selling: Why do Investors go short?

Short selling is considered useful for two primary reasons: speculation or hedging. For example, speculators use short selling metrics and tools to take advantage of a potential depreciation in a particular security or generally across the over priced Stock market.

Hedgers employ the strategy to protect gains or minimize losses in a portfolio or same security.

It is noteworthy that savvy individual and long term investors now and again engage in short-selling strategies for both hedging and speculation at the same time.

Hedge funds remain among the vast majority of active short sellers, frequently using short positions in select stocks or sectors, hedging their long position in stocks. That’s all in this section! let’s move forward.

When is short selling right?

Short selling is not a strategy many investors use. This is mostly owing to the expectation that the short selling stocks will appreciate in value over time.

In the long run, the stock market conditions show every tendency to appreciate. That does not stand in doubt despite the bear market’s punctuations. Short selling remains riskier than buying other stocks for the ordinary investor with a long-term investments horizon.

Short selling is right – in particular situations. These can be never-ending bearish trend markets or if a company is going through financial problems. Be that as it may, only mature investors with high-risk tolerance and cognizance of selling short associated risks ought to attempt it.

Is Short Selling Costly?

When you are short selling, trading commissions are not the only expense you have to reckon with. There are other costs, namely:

-

Margin interest

Since short selling can usually be undertaken in margin accounts, the short seller has to pay interest on borrowed funds.

-

Stock borrowing costs

Some companies’ shares may be challenging as regards borrow, owing to high short interest or limited share float.

To borrow these shares for short selling, the short term traders have to pay a hard-to- borrow fee based on an annual rate. This can be relatively high, prorated for the number of trades the short trade is open.

-

Dividends and other payments

Essentially, the short seller is also compelled to make dividend payments to stock owners on the shorted stock, besides payments for other corporate events linked to the shorted stock, like spinoffs and stock splits.

Is short selling profitable?

Hypothetically, the large profits you may make from short selling a stock is 100%, given that a stock’s lowest market price for trading is $0.

However, the actual cost on a good short trade can potentially be less than 100% once short position associated costs are factored in. These may be margin trading and stock borrowing costs.

Can a trader lose more than he invested in short sales?

Yes, you may lose money much more than you have invested in short sales. In theory, your losses can touch infinity.

Conversely, there’s the ‘long’ strategy, which says that the maximum gain on a stock is theoretically infinite. However, the most you stand to lose is the initial investment or the amount you have invested.

By way of illustration, note how uninhibited price appreciation can inflict devastating losses on a short sale.

An investor who had a 100 share short position in GameStop as of December 31, 2020, would be confronted with a $106.16 per share loss, or $30,616, in case the short position were still open, come January 29, 2021.

Since the stock soars from $18.84 to $325 over this month-long duration, -1,625% would be the investor’s return.

Is Short Selling Bad?

There’s a bad odour about short selling overall – the EU is especially unforgiving. We can thank shyster short-sellers who, with scammy tactics, drove down stock price movements.

When used as it was meant, however, short selling eases the functioning of the open markets by offering liquidity.

It even acts as a reality check for fantastical expectations, thus diminishing the inherent risks of market bubbles, allowing for downside risk mitigation.

Safer Alternatives: Profiting from Price Fall

Safer alternative to Short selling or profiting from a stock’s decline are options and inverse ETFs. Buying a put option allows you the right, but not the obligation to sell a stock at a particular strike price before the option contract expires.

But, of course, the buyer has his heart set on the stock plummeting. So selling at the strike piece would be a jackpot moment!

Inverse ETFs have swaps and contracts that effectively copy a short position. At this point, an inverse ETF is made up of diverse derivatives to profit from a depreciation of the underlying benchmark.

Inverse ETF investing is largely akin to holding diverse short positions. The latter is also concerned with borrowing securities and selling them in the hope of buying them back at a lower current market price.

Conclusion:

Market regulators in the UK and the US believe the ability to take long and short position of special importance in many limited risk management and investments strategies can prove advantageous to a diverse range of investors. Examples of the latter include pension funds and more secure mutual funds.

Furthermore, a large number of hedge fund investors maintain balanced long and short positions. Since short selling can usually be undertaken in margin accounts, the short seller has to pay interest on borrowed funds.

Meantime, one more advice is to read all the basics of the market volatility, conduct own research and practice before you proceeds forward as most investors end up losing more money than invested in Short Selling.

Therefore, if they are not able to increase or were mandated to reduce short positions, it would have a corresponding impact on their ability to increase or maintain long positions.

On the other hand, regulators like the Securities and Exchange Commission (SEC) have the right to restrict short selling based on the type of investor. Said regulators see short selling as critical pivots of the liquidity provision and higher price discovery as stipulated by market makers.

In addition, the regulatory body may impose several restrictions on Short Selling anytime. Either you are a seasoned trader or in the hands of financial services provider like InvestBy. Only then can you hope to steer clear of trouble while Short selling. In case you have any question, you can reach out to the broker anytime.

That’s all! hope you have understand the topic and this article have helped you in your trading journey.