Many beginners are often bewildered regarding the importance of fundamental analysis. They think about why it is essential to evaluate the stocks fundamentally while trading or investing in any asset class. The fundamental analysis gives you detailed information about the company’s history, its ability to survive in tough times, whether the company has enough funds to overcome the situation of bankruptcy, future plans, product pipeline and other important information that plays an important role in price movements.

Another important thing that we are going to talk about today is earnings per share (EPS). It is the concept of understanding the company’s profitability. Earnings per share of the company clearly indicate the profit company is making for each share. Both parameters play essential roles in the stock market.

They are used as important indicators for evaluating the company in which you are looking to invest. We will discuss both fundamental Analysis and EPS in detail in this article.

Understanding Fundamental Analysis

Conducting fundamental analysis is a holistic approach to learning about the company you are looking to invest. It gives the intrinsic value of the stock. You have to understand the company from various perspectives, and you can achieve all knowledge from several perspectives using the fundamental analysis. Fundamental analysis is a strategy that helps you recognise key characteristics of wealth-creating organisations, giving you the confidence to invest for the long term.

Fundamental securities research aids in forecasting future price movements and determining if a stock is undervalued or overvalued. You may also use fundamental stock evaluation to assess a company’s performance by keeping a close eye on its key metrics and crucial economic indicators. At the same time, it aids in the evaluation of a company’s strengths and ability to outperform its competition.

Separating the daily short-term noise in stock prices and focusing on the underlying business performance is crucial for an investor. Fundamental analysis act as a bedrock of an informed investment decision. The stock prices of a fundamentally sound company tend to grow over time, creating wealth for its owners.

Separating investment-grade companies that produce money from companies that destroy wealth has always been the trick. There are a few characteristics that all investment-grade companies have in common. Similarly, all wealth destroyers share a few characteristics that an observant investor can spot.

Importance of Fundamental Analysis

Fundamental study assists you in making better investment decisions. For example, stock fundamental analysis can assist you in determining their fair value. The fundamental stock analysis also aids in comprehending a company’s business model and management’s operations, all of which are necessary for making sound investment decisions.

Most traders think that only investment banking professionals, fund managers, chartered accounts, financial experts can be good fundamental analysts. But it is one of the major misconceptions about the fundamental analysis. Any level of trader can conduct an effective fundamental evaluation. You just need to invest your time in learning the right skills and furnish them regularly with time.

Mainly this kind of analysis is used for analysing the business while long-term investing. For short-term investment strategies, traders rely on technical analysis or evaluation. Technical analysis (TA) aids in obtaining immediate short-term gains. It aids in market timing for better entry and exit. Only by making wise long-term investments can one accumulate wealth. However, TA is ineffective in terms of generating money.

Earnings per share is also a part of the process of fundamental stock analysis. It is one of the numbers of outstanding tools used for fundamental stock evaluation. In addition, EPS is also known for providing an important aspect of fundamental analysis called the P/E ratio.

Now let’s dive deep into earnings per share.

Earnings per share (EPS)

Earnings per share (EPS) is a measure of a company’s financial health. They may also assess the company’s stock price and market capitalisation. The simple definition of EPS is that it is a per-share measure of a company’s profitability. EPS allows businesses to compare their results to those of their competitors. Investors consider a corporation to be more profitable if its earnings per share is high.

Earnings per share is the earnings remaining for shareholders divided by the number of outstanding shares. When investors compare a company’s EPS to that of other companies in the same industry, the number becomes more valuable.

Earnings per share is a key metric for determining a company’s profitability and financial health. However, there are a few things that investors should be aware of when it comes to earnings per share. First, as previously stated, EPS represents a company’s profitability, implying that the company’s high dividend payout ratio may be increased.

Calculation of EPS

Earnings are a company’s revenue minus operating expenses. You can view earnings per share in a cash flow statement, balance sheets and income statements.

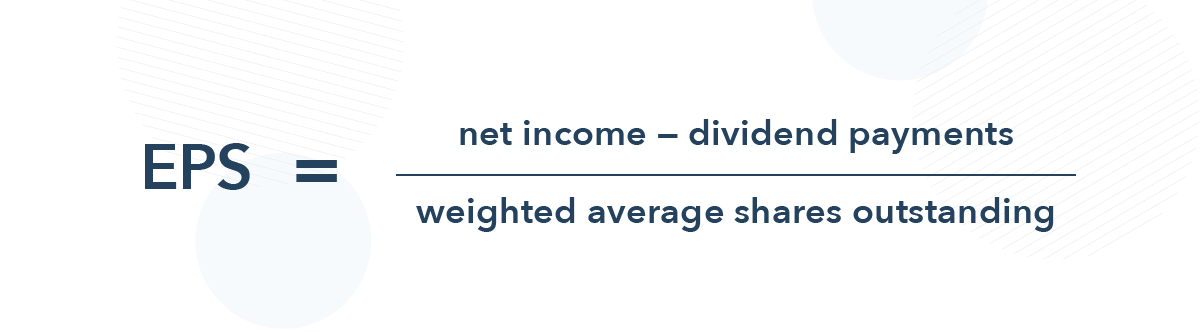

The EPS of a corporation can be calculated in a few different ways. The first step is to deduct preferred dividends from net income and divide by the number of outstanding shares at the end of the quarter. Another method is to deduct preferred dividends from net income and divide them by the weighted average of outstanding shares.

Consider the case of a corporation with ten thousand outstanding shares that make a profit of $10 million. Now, the earnings per share would be:

10,000,000/10000 = $1000 per share

As a result, the EPS gives us an idea of the profits made per share. Obviously, the higher the EPS, the better for the company’s stockholders.

The Price to Earnings ratio is calculated by dividing the current market price by EPS. Thus, for every dollar of profit generated by the company, the P/E ratio represents market participants’ willingness to pay for the shares.

Why Earnings per share?

Investors may readily estimate the company’s current and expected stock value using EPS. Analysts and investors closely monitor the company’s earnings since they can influence the stock price in the long run. It also aids investors in determining whether the stock price is justified based on market performance and stock market research.

When a company reports high results for a quarter, it’s usually a hint that the stock price will rise. If earnings are declining, on the other hand, it’s an indication that the stock price is likely to fall. Thus, many investors will use this number to determine whether or not investing in a specific firm is a wise decision.

When businesses produce some money, they can either reinvest it in the business or pass it on to shareholders in the form of dividends or share buybacks. Earnings per share plays a huge role here. While the first option may assist the company in increasing earnings, the second alternative allows shareholders to profit immediately. Both choices should, in theory, assist the company in increasing earnings, resulting in investor returns.

Even if a company’s earnings aren’t blowing the roof apart, any gain can hint at future profitability. However, because various factors influence this assessment, investors may never be certain that their predictions will come true.

Types of EPS

There are mainly two types of EPS based on a company’s capital structure – Basic EPS and Diluted EPS. Although there are many distinct types of earnings per share, each one represents a different part of the financial metric. Therefore, these businesses must report both primary and diluted earnings per share in their earnings reports.

Diluted EPS, on the other hand, is not the same as basic EPS. It’s a formula for determining how good a company’s profits per share (EPS) would be if all convertible instruments were exercised. All outstanding convertible shares, stock options, and warrants are included in the convertible securities. The diluted EPS is always smaller than the basic EPS unless a company has no extra potential outstanding shares, which is unlikely.

However, the more conservative diluted EPS figure is usually the focus. Dilutive EPS is a cautious indicator since it represents the worst-case situation for EPS.

Significance of EPS in fundamental evaluation

EPS is significantly important in fundamental stock analysis. Financial results are usually released quarterly by businesses. Some, on the other hand, adhere to a fiscal calendar. Because earnings are so important to investors, stock analysts will create earnings estimates. After that, the investors compile all of the estimates into a consensus earnings forecast. However, if the company’s results fall short of expectations, the stock price will drop.

EPS is one of the most important evaluations during earnings season, even though analysts and investors look at all financial figures. In reality, earnings per share and sales are the two most generally analysed indicators when looking at a company’s stated financial results.

Publicly traded corporations are required by federal securities legislation to release their financial statements on a regular basis. Earning surprise occurs when a company’s earnings exceed expectations, leading to a stock price increase.

This is how per share earnings affects the investors’ sentiments. The value of an outstanding common stock is referred to as earnings per share. It is a critical metric for determining a company’s financial health. EPS is primarily disclosed on a company’s income statement, and only publicly traded corporations are required to report it.

It is unlikely that everyone who has convertible preferred stock, warrants, or options will convert their stock at some point. Even so, if things are going well, it’s possible that all of them will be converted to common stock.

Limitations of EPS

- The earnings per share does not accurately reflect a company’s performance. However, many of these initiatives are only suitable for the short term, which impedes the business’s venture.

- EPS also ignores cash flow. Because management is so focused on raising profits, they may begin selling to bad clients who don’t pay or sell at lower margins.

- Most firm owners can influence EPS by purchasing back their own shares to reduce the number of outstanding shares. Investors may make decisions to maximise EPS in the short term, but this could harm the company’s long-term prospects.

- When it comes to determining a company’s ability to repay its debt, cash flow is critical. However, because cash flow is not taken into account when calculating EPS, a high EPS may still be unhelpful in determining a company’s viability.

- Because EPS does not take inflation into account, the growth of the company it indicates may not be true in the first place. For instance, the overall cost of products and services rises.

Bottom Line

Both fundamental Analysis and EPS are interrelated. EPS plays a huge role in analysing the performance, sustainability, market position and other important parameters of the company. When assessing a company’s financial health, one of the most important things to consider is earnings per share. You can successfully conduct fundamental analysis with essential data with the help of brokers like PrimeFin.

To determine the EPS, one has to divide the company’s total profit by the total number of outstanding shares. If you’re thinking about buying shares in a company, examining its earnings per share is one way to see if it’s on track to become profitable. We hope you understand the importance of EPS with the help of this article.