Capixal is a Cyprus-based brokerage platform that offers to trade on over 350+ financial trading assets such as Forex, Commodities, Shares, Cryptocurrencies, and Indices.

The broker stepped into the financial market in 2021. The brokerage company is regulated by the Cyprus Securities and Commission Exchange (CySEC).

IFC Investments Cyprus Ltd provides a trading service under the brand name “Capixal” through the most popular and advanced platforms: MetaTrader4 and WebTrader.

Read this Capixal Review carefully for further details such as spreads, the leverage offered, customer support details, minimum deposits, etc.

Is Capixal Scam Or Legit?

Capixal is a legal brokerage firm regulated and authorized by the Cyprus Securities and Exchange Commission with the license number: 327/16.

As mentioned before, the broker operates under IFC investments Cyprus Ltd, a company registered in Cyprus with registration no. HE342390.

In addition, the broker is also regulated by various financial authorities like FSA, HANFA, AFM, and 23 others.

Moreover, the broker provides its services in various countries such as Austria, Finland, Ireland, Malta, Slovakia, Bulgaria, Luxemburg, Italy, Netherlands, Slovenia, Croatia, Germany, Latvia, Greece, Liechtenstein, Poland, Sweden, Denmark, Hungary, Lithuania, Portugal, Romania, Estonia, and Iceland.

Pros and Cons:

Pros

- Well-Regulated broker

- Advanced MT4 and WebTrader Platforms Available

- Commission-free trading

- Minimum deposit: $250

- More than 350 Financial Instruments

- Qualify Research and Educational Material

- 50% Discount Available on Overnight Swap Charges

- Strict security measures for clients’ data safety

- Offers Negative Balance Protection

- Offers trading on cryptocurrencies such as Bitcoin, Ripple, Litecoin, etc.

Cons

- Does not accept U.S. clients

- MT5 Not Available

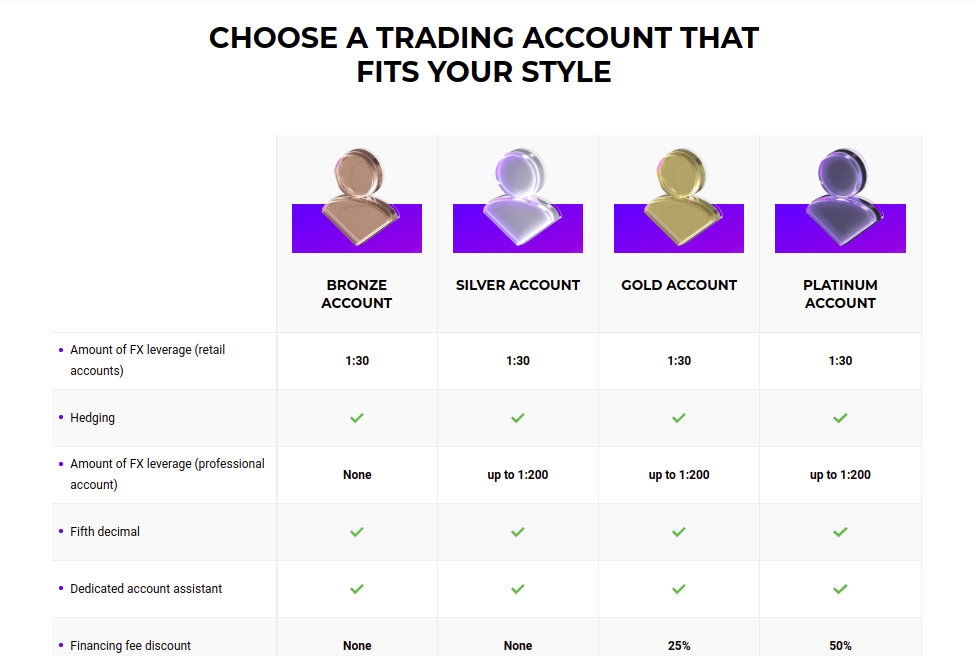

Types of Accounts Offered?

The broker provides three different account types: Silver, Gold, and Platinum. In addition, the Professional Account is available with exclusive features for experienced traders.

Moreover, the platform offers a free demo account, which provides a perfect place for testing new strategies and experiencing a live trading environment. The initial deposit is $250 for opening an account. Readout complete details about all three types of accounts below.

Silver Account:

The features of the Silver account are as follows:

- Minimum Deposit: $250

- CFD trading on 350+ assets

- Financial leverage (Retail accounts): 1:30

- Hedging Allowed

- Financial Leverage (Pro Accounts): 1:200

- Fifth Decimal Available

- Dedicated Account assistant

- Zero Commission

- Average execution speed: 0.08

- Free Education Hub

- Available currency pairs: GBP/USD, EUR/USD, USD/JPY, USD/CHF, AUD/USD, USD/CAD, NZD/USD, EUR/GBP, and others.

Gold Account

This account type is created keeping in the mind both novice and professional traders. The features of the Gold account are as follows:

- Minimum Deposit: $250

- CFD trading on 350+ financial instruments

- FX leverage (Retail accounts): 1:30

- Hedging Allowed

- Financial Leverage (Pro Accounts): 1:200

- Financing fee discount: 25%

- Fifth Decimal Available

- Dedicated Account Manager

- Free VPS

- Zero Commission

- Average execution speed: 0.06

- Free Education Hub

- Available currency pairs: GBP/USD, EUR/USD, USD/JPY, USD/CHF, AUD/USD, USD/CAD, NZD/USD, EUR/GBP, and others.

Platinum Account

This account type is specially created for seasoned traders. The benefits of the Platinum account are as follows:

- Minimum Deposit: $250

- CFD trading on 350+ financial instruments

- FX leverage (Retail accounts): 1:30

- Hedging Allowed

- FX Leverage (Pro Accounts): 1:200

- Free VPS

- Customized investment news

- Dedicated Account Manager

- Fifth Decimal Available

- Financing fee discount: 50%

- Real-time markets updates

- Dedicated Account assistant

- Commission-free

- Average execution speed: 0.06

- Free Education material

- Available currency pairs: GBP/USD, EUR/USD, USD/JPY, USD/CHF, AUD/USD, USD/CAD, NZD/USD, EUR/GBP, and others.

Demo Account:

The platform offers a free Demo account type to traders who want to test their new trading strategies. Novice traders can improve their trading skills and strategies through this account option. Traders can experience live trading conditions on this account.

Professional Account:

Experienced traders can go with a Professional Trading Account where they can get tighter spreads with lower trading costs and swap fees. A Professional Account also provides access to exclusive VIP educational resources, news alerts, a dedicated customer support team, and maximum leverage. This account type best suits seasoned or experienced traders.

How To Open An Account?

The account creation process on the Capixal broker platform is very quick and hassle-free. Traders can easily open an account in a few simple steps. But before you start trading online, make up your mind about which accounts you like to go with.

Here’s a quick guide to opening a live trading account:

- Visit the official website of Capixal and click on the ‘Open Account’ button available on the right-hand side of the homepage, or you can also jump on the account opening page through the following link available under account details.

- Enter your basic information such as first name, e-mail address, mobile number, and country code. Then click on the submit button.

- A new page will open on your screen, which consists of your prior trading-related questions. You’ll have to answer all the questions properly.

- Now, complete the verification process by uploading a copy of your government-issued identity card. Click on the submit button and deposit the initial amount set by the broker.

- Now you are all ready to start live trading.

Available Trading Platform?

The broker offers some most popular trading platforms, such as MetaTrader4 and WebTrader. Both platforms consist of advanced tools for fulfilling the requirements of both seasoned and beginner traders.

Traders can choose a preferred trading platform based on their trading needs, skills, and experience. Here’s a detailed overview of available platforms:

MetaTrader4:

MetaTrader4, popularly known as MT4, provides multiple inbuilt features such as automatic orders, trading history, one-click trading, instant execution, and others. A trader can access the MT4 platform through web, mobile, and desktop.

The MT4 platform is available for both Android and iOS. The key features of the MetaTrader4 trading platform are:

- 9 timeframes

- 20+ analytical objects

- 30 innate technical indicator

- Fast and interactive charts

- Easy and simple to understand user-interface

- Technical Analysis Indicators

WebTrader:

Traders can access the market from anywhere with the help of the WebTrader platform. It offers customized market alerts that help a trader to hold the top position for great results.

To access the WebTrader, you’ll just need a web browser and a good internet connection.

Some key features of WebTrader are:

- Instant access to financial markets

- Complete package of analytical instruments

- Trading history records.

- Multilingual support agents

- Technical Analysis Indicators

- Offers analytical reports

Mobile Application:

In addition to the MT4 and WebTrader, the broker also offers an advanced mobile app consisting of features like a fully customizable account, a complete package of analytical tools, etc.

Some important features of the broker’s mobile app include:

- One-click trading options.

- Android and iOS are accessible.

- CFD trading on 350+ financial assets.

- 60+ professional analytical tools.

- Customizable trading environment.

- Real-time balance check option.

- Technical Analysis Indicators

- Stop Losses/Take Profit set up.

- Multilingual professional support.

- Available on Google Play Store and Apple App Store.

Major Trading Instruments Available:

- Forex: The Forex market is a leading financial market due to high trading activity, high liquidity, and wide currency choice. The broker provides CFD on 45+currency pairs.

- Stocks: The broker offer CFD on 150+ shares, including some big names such as Apple, Amazon, Nike, Tesla, and Zoom.

- Cryptocurrency: More than 30 cryptocurrencies such as Bitcoin, Ethereum, etc are available on the broker’s platform.

- Commodities: The broker offers CFD trading on 25+ commodities like corn, sugar, cocoa, energies, petroleum, and precious metals.

- Indices: 20+ major indices such as DOW, NSDQ, SP, NK, ASX, and various others are available.

- Metals: More than 3 metals such as Gold, Silver, and others are available.

Fees, Commission & Spreads:

The broker provides commission-free trading to their retail clients with tight spread and high leverage. A Trader must note that spread and swap charges are different for all accounts and instruments.

Spreads for the currency pair EUR/USD:

- Silver: Starts from 3 pips

- Gold: Starts from 2.5 pips

- Platinum: Starts from 2 pips

The broker charges overnight fees/ Swap fees if the position remains open overnight (22:00) GMT. Must note that if the position is being held throughout the weekend, a three-day swap charge will be charged on Wednesdays.

On the other hand, Gold and Platinum account offers 25% and 50% swap discounts respectively.

Inactivity Fees:

- 61 days: 160 EUR

- 181 days: 200 EUR

- 271 days: 500 EUR

Maximum Leverage:

The platform offers leverages on the basis of account types. For retail accounts, the leverage offered is 1:30 for all three types of accounts. On the other hand, the broker provides 1:500 leverage to their Pro (Professional account) holders.

Deposit and Withdrawal Process:

Capixal broker doesn’t charge any deposition and withdrawal fees from its clients. Traders can do transactions through major payment methods including:

- Debit / Credit Card

- Bank transfer

- Wire transfers

- Skrill

- PayPal

- Neteller

- Webmoney

- Popular E-wallets

Users can request withdrawal anytime, which may take 1 day to process. On the other hand, the broker doesn’t charge any deposit fees.

Educational and Research Support:

Capixal trading platforms provide quality education material on its website for helping traders to enhance their knowledge, information, and trading skills. A trader will get access to financial articles, VODs, e-books, Courses, and tutorials.

In addition, the broker also offers a wide range of research trading tools, an easy user-friendly interface, and a set of technical indicators that helps in the trader’s success.

Available Research Tools include:

- An Economic Calendar

- Report Season Calendar

- Daily News Alerts for Markets

- Trading Signals

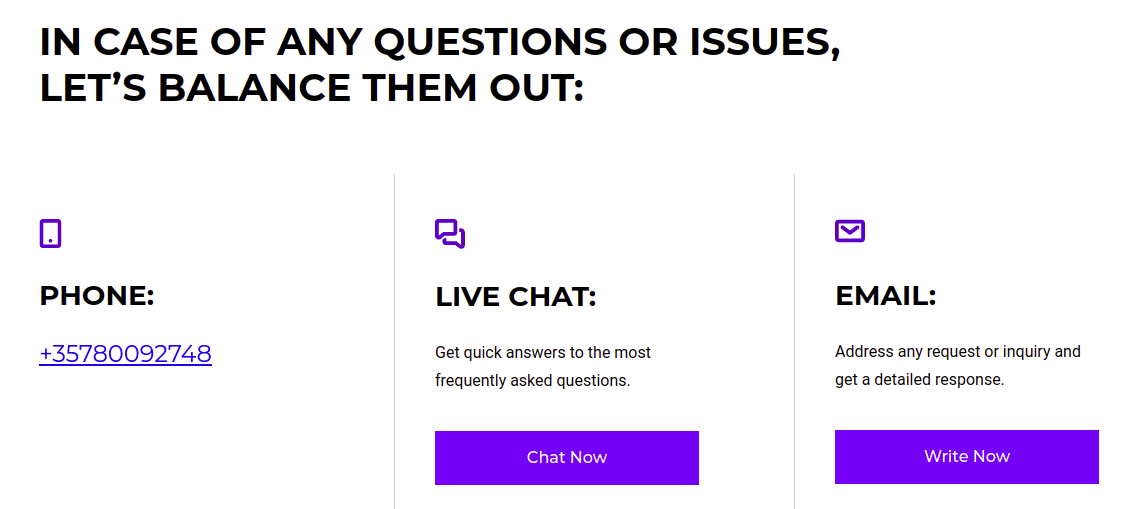

Customer Support:

The customer support service is available 24/5 from Monday to Friday – 08:00 to 07:00 GMT. The broker provides customer service in multiple languages like English, Spanish, German, Dutch, Swedish, and Polish.

Traders can also contact them through the contact form available on the “Contact Us” page. In addition, customer support responds quickly to users’ queries through live support.

The broker consists of a live chat option, e-mail, and phone call options for customer support services. FAQ section is available with a pre-defined answer for common issues. Overall, the broker provides outstanding customer service with a 4.5/5 rating.

Readout contact details of the broker from the points given below.

- Registered Office Address: Arch. Makariou III, 242. P.Lordos center, block A, 2nd floor, Office 203, Limassol, Cyprus.

- Telephone Number: +35780092748

- E-mail: [email protected]

- Live Chat

- Social Media: Facebook, Twitter, etc.

Conclusion:

The broker Capixal is ahead of the competition because of the advanced features it exhibits to people. It is full of transparency and provides more than 350 assets. The leverage you get here is 1:500. The support system is multilingual and dedicated to all its traders.