Vantage FX is one of the few brokerage houses that has been operating for a decade now. However, all these years bought several controversies for the broker, whether it’s related to changing its brand name to Vantage Markets or halting clients’ withdrawals all of a sudden. But that’s just a common scenario in the finance industry.

What makes Vantage stand out from other online CFD trading firms is its offering of both STP and ECN accounts. Meanwhile, the broker claims to offer the best execution speed and favourable trading conditions, but to what extent are these claims meant to be true? Let’s find it out.

To help out our readers & potential platform users, we created an in-depth Vantage FX Review and listed out the 10 key considerations you should look at before starting to trade with Vantage.

Vantage FX 2023: A Detailed Overview for Traders

VantageFX, rebranded as Vantage Markets is a registered multi-asset CFD provider in Vanuatu. The brokerage holds over 30 offices across Asia, Europe & Australia. However, it is restricted to operating in Canada, China, Romania, Singapore, and the United States.

The brokerage provides CFD trading services on 1000+ underlying assets across Forex, Commodities, Shares & Indices through MT4, MT5 and the proprietary trading app – Vantage App.

Vantage also offers competitive trading conditions, including low spreads, high leverage, and fast execution speeds. The broker offers a range of account types to suit different traders’ needs, including standard accounts, Islamic accounts, and professional accounts.

Read Also- Investby Review 2023

Is Vantage FX Regulated CFD Broker?

Yes, Vantage FX is a regulated & safe brokerage firm authorised by multiple regulatory authorities, including the Australian Securities and Investments Commission (ASIC), AFSL no. 428901, the Cayman Islands Monetary Authority (CIMA) SIBL number 1383491, and the Financial Sector Conduct Authority (FSCA) of South Africa with license number 51268.

Additionally, the brokerage is a member of the Financial Commission, which ensures the safety and security of traders’ funds and the integrity of the trading environment.

The broker’s offering of funds insurance upto $20,000 through the Investors Compensation Fund (ICF) is a commendable step towards the clients’ fund safety.

Thus, considering all the factors through this detailed VantageFX review, Vantage is considered a low-risk broker and is not a scam.

Trading Instruments Offered on VantageFX 2023

The broker’s offered list of products & asset classes is relatively broader, with over 1000+ underlying assets available for CFD trading.

It offers to trade US, Australian, and European stocks, commodities, and indices, with all major & minor currency pairs. However, the broker trails behind in offering Crypto trading to traders, which might be counted as its biggest drawback.

At the same time, the broker has listed ETFs & Bonds trading on the website, but many users have complained about the unavailability of both these markets.

Here’s a list of products & trading instruments offered by Vantage:

- Forex – 40+ Currency Pairs

- Indices – 15 Major stock markets

- Precious Metals – Gold Trading, Silver Trading & Copper Trading

- Soft Commodities – Cocoa, Coffee, Sugar, Orange Juice & Cotton

- Energy – Gasoline, Oil Trading, Natural Gas & Low Sulphur GasOil

- ETFs – SPY, QQQ, BND, GLD & IWM

- Share CFDs – US, UK, AU & European Stocks

- Bonds

Vantage FX Commission & Fees: Understanding Trading Costs

Vantage trading fees are charged on a hybrid fee model, which consists of both Spreads & Commission charges. At the same time, there are withdrawal fees & Swaps, which are relatively higher than the industry standards.

Here’s a breakdown of Vantage Trading & Non-trading fee Structure:

- Spreads – From 1.4 (Standard STP); From 0.0 (Raw ECN); From 0.0 (Pro ECN)

- Commission – USD $3 (Raw ECN Account); USD $ 1 (PRO ECN account)

- Swap Rates – Vary depending on Instrument & position size

- Vantage Fx Withdrawal Fees – 2% fee, capped at $30 per transaction; 1% (Skrill)

- Deposit Fees – $10; 4.9% + 0.29 USD (Neteller For Vietnam Clients)

Read Also – Trade245 Review

Vantage FX Leverage Options

Vantage offers leverage ratios ranging from 100:1 to 500:1, depending on the type of account you choose and the financial instrument you are trading.

However, the specific amount of leverage you are offered may also depend on your level of trading experience and the jurisdiction you are trading from.

For example, if you are trading from within the European Union, you may be subject to ESMA regulations, which limit leverage on major currency pairs to 30:1 for retail clients and 500:1 for professional clients.

Professional clients must meet certain criteria, including having relevant experience in the financial sector and meeting certain financial criteria. Overall, Vantage is a high-leverage forex trading broker.

Vantage FX Trading Platforms: Features and Specifications

The broker offers services through its advanced proprietary trading platform – Vantage App, MetaTrader platforms & Copy Trading platform.

All the available platforms have clean & user-friendly interfaces, with easy access to drop-down menus. You can use the charts and other trading tools through these available platforms:

Copy Trading

Vantage offers social trading through third-party service providers such as ZuluTrade, MyFXBook Autotrade, and DupliTrade.

This feature allows traders to automatically copy the trades of experienced traders, giving them exposure to the markets without requiring extensive knowledge or experience.

MetaTrader

Vantage FX supports the MetaTrader platform, including both MetaTrader 4 and MetaTrader 5. These platforms are popular among traders due to their ease of use and ability to automate trading through the use of expert advisors (EAs), forex trading signals and custom indicators. The MetaTrader platforms are available on desktop and mobile.

Vantage App

VantageFX offers a mobile trading app that is available for both iOS and Android devices. The app allows traders to manage their accounts, monitor their positions, and place trades on the go. The app has a user-friendly interface and provides access to real-time Forex market data and analysis tools.

WebTrader

The broker offers a browser-based trading platform called WebTrader. This platform allows traders to access their accounts and trade from any computer with an internet connection. WebTrader provides access to advanced charting tools, real-time market data, and a range of trading instruments.

ProTrader

The platform is specially created for Indian traders offering them advanced indicators, over 50 technical drawing tools and a complete suite of tools for in-depth market analysis. The platform is powered by TradingView.

Vantage FX Account Types: In-depth Comparison

PRO ECN, RAW ECN, STP, and CENT are the four account types available at Vantage FX, each with its own minimum spreads, minimum deposit, commission, and other features.

-

- Vantage FX PRO ECN account has the tightest spreads (0.0 pips) and the lowest commissions (from $1.50 per lot per side), making it suitable for professional traders who trade large volumes. The minimum deposit requirement is $10,000. It offers access to MT4 & MT5 platforms, expert support and unlimited demo trial use.

- RAW ECN account has similar spreads to PRO ECN but has a lower minimum deposit requirement ($50), making it accessible to a wider range of traders. It charges a commission of $3 per lot per side.

- STP account offers no commission trades, making it ideal for traders who prefer a simpler fee structure. Additionally, the minimum deposit requirements are similar to RAW ECN accounts & spreads start from 1pip with zero commission on trades.

- CENT account has lower deposit requirements ($50) and selected products for Cent account trading conditions. There are commission charges that go up to $3 per lot per side.

- Vantage FX Demo Account is a practice account that allows traders to get a feel of real market conditions without risking their capital. They can place free trades or testify new strategies on the free demo account option.

Read Also- Investfw Review

Overall, the choice of account type depends on the individual trader’s needs and preferences, so it is essential to carefully evaluate the different features and select the most appropriate option.

How to Open an Account with VantageFX: Step-by-Step Guide

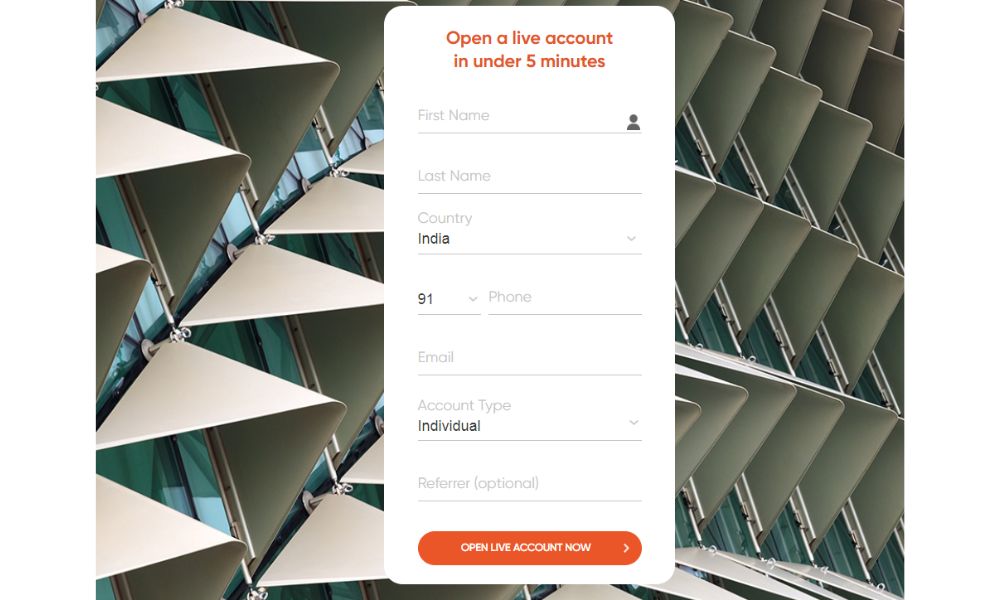

Here’s a step-by-step guide on opening a Vantage live account:

- Visit the website at www.vantagemarkets.com and click on the “Live Account” button in the top-right corner of the page.

- Choose the account type you want to open: PRO ECN, RAW ECN, STP, or CENT. You can learn more about the features of each account type in the account type comparison above.

- Fill out the account application form with your personal information, including your name, email address, and phone number.

- Verify your email Id by tapping on the verification link sent to your registered email.

- Provide additional information required to verify your identities, such as your DoB, address, and ID documentation.

- Once your account application is complete and your identity has been verified, you will receive an email with Vantage FX login details, including your username and password.

- Log in to your account using the Vantage FX client portal or the MetaTrader 4 or 5 platform to start trading.

How To Login Into Vantage FX & Trade?

To log in to your Vantage account and start trading, follow these steps:

- Go to the website or download the Vantage app and click on “Client Login” at the top right corner of the homepage.

- Enter your email Id and password in the login page.

- Select the trading account you wish to use and click “Login”.

- Once you are logged in, you can access your trading platform by clicking on “MT4 WebTrader” or “MT5 WebTrader”.

- You will be redirected to the trading platform, where you can start trading by selecting the financial instrument you want to trade, analyzing the charts, and placing your orders.

- If you prefer to use the desktop version of the trading platform, you can download the MT4 or MT5 platform directly from the Vantage Markets website and log in using your account details.

Deposit and Withdrawal Conditions on Vantage FX

The deposits & withdrawal conditions of Vantage should be counted among its unique selling point (USP). Firstly, there is no dearth of payment methods available and secondly, there is zero fees charged on both deposits & withdrawals.

Here’s a breakdown of the Vantage deposit & withdrawal conditions

Deposits

- Payment Options: The platform supports a variety of payment methods, including credit/debit cards, bank transfers, and electronic payment systems like Skrill, Neteller, China Union Pay, AstroPay, Broker-to-Broker and FasaPay.

- Vantage FX Minimum Deposit Requirements: The minimum deposit requirement for RAW ECN, STANDARD STP, and CENT accounts is $50. However, for PRO ECN accounts, the minimum deposit requirement is $10,000.

- Deposit Time: Deposits are usually processed within 1-2 business days, but the time may vary depending on the payment method used.

Withdrawals

- Withdrawal Options: The platform allows withdrawals through the same payment method used for depositing funds.

- Withdrawal Limit: There is no minimum withdrawal limit, but the available balance in your trading account must cover the withdrawal amount and any fees incurred.

- Vantage FX Withdrawal Time: Most withdrawal requests are usually processed within 1-2 business days, but the time may vary depending on the payment method used.

- Withdrawal Fees: The broker does not charge any fees for withdrawals, but third-party fees may apply depending on the payment method used.

Troubleshooting Vantage FX Withdrawal Issues: Tips and Solutions

During our investigation for Vantage Review, we scrolled down Google Reviews and Trustpilot to get a clear idea of the broker’s reputation among its existing users. While Vantage FX Google reviews indicate it to be a good brokerage, the users on Trustpilot have rated it 3.2/5 stars, with many of them raising concerns over Vantage FX withdrawal problems. Some users have even reported that the platform had halted their withdrawal all of a sudden without any reason.

Vantage FX Educational and Research Support

In terms of educational and research support, Vantage FX offers a decent range of resources for traders, but it may not be as comprehensive as some other forex brokers in the industry.

For new traders, Vantage provides a series of articles, videos, and tutorials explaining forex trading basics, market analysis, trading psychology, and various MetaTrader platform tutorials.

However, some of the more advanced educational content, such as the Pro Trader videos, requires an initial deposit of $1,000 to access.

In addition to its educational resources, the platform provides research materials primarily from third-party content providers such as Trading Central.

The broker also offers an economic calendar, forex education, trading tools, forex analysis, forex market news, forex trading strategies and client sentiment data. However, it may lack a variety of in-house content compared to some other forex brokers.

Customer Support on Vantage FX

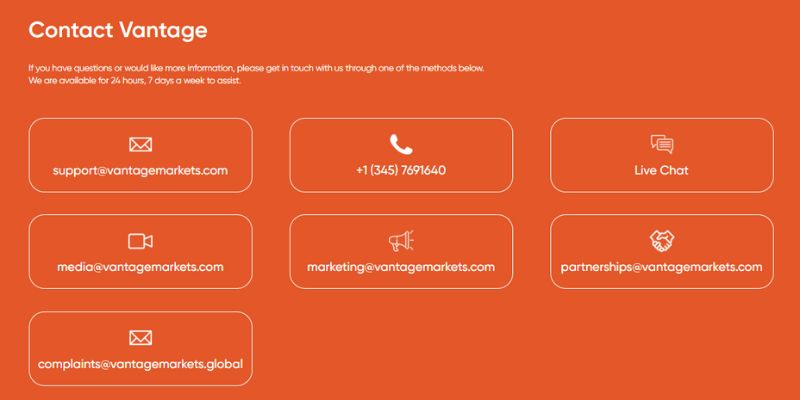

Vantage offers commendable customer support to its clients 24/7 via phone, email, and live chat. The phone support number is +1 (345) 7691640, and the email address for support is [email protected].

The broker also provides multilingual customer support to cater to clients from different regions globally. Additionally, the website has a comprehensive FAQ section, which provides answers to common questions and concerns.

Overall, Vantage FX reviews from clients regarding its customer support are exceptional, with many clients praising the prompt and efficient responses from the support team.

Pros and Cons of Trading on Vantage FX

| Pros | Cons |

| Regulated by reputable financial authorities such as ASIC and FCA | Limited range of markets available compared to some other brokers |

| Offers competitive spreads and low commissions | Deposit of $1,000 is required to access some of the educational and research materials |

| Provides access to MetaTrader platforms with advanced charting and trading tools | |

| Offers ECN & STP accounts | |

| Supports multiple deposit and withdrawal methods, including cryptocurrencies |

Conclusion: Is Vantage FX the Right Broker for You?

Based on the Vantage FX Review, it appears to be a reliable and competitive broker for forex and CFD trader. Its range of account types, competitive pricing, and extensive trading platform options provide traders with a range of choices to suit their needs.

The broker also offers a decent range of educational materials and market analysis resources for new traders, although some of the more advanced resources require a significant deposit.

Overall, whether or not Vantage FX is the right broker for you depends on your individual needs and preferences as a trader. Meanwhile, it is important to note that Vantage falls short in offering free educational access and competitive fees, which are considered the primary elements for trading.

For traders who are looking for a wider range of trading instruments or prefer a more personalized approach to customer support, InvestFW may be a better fit.

The broker offers a diverse range of trading instruments, including forex, stocks, commodities, and cryptocurrencies, with competitive spreads and free access to educational & research tools.