ABInvesting is considered one of the best online brokers for the coming year. It is founded by a group of Wall Street veterans, who have a combined experience of more than 25 years. The trading platform is designed with the objective of giving traders the best trading environment in the industry. The ABInvesting Review will highlight the different features that will be provided to traders by this leading online broker.

What is ABInvesting?

ABInvesting is a forex and CFD brokerage platform offering trading services on all major financial markets, with best-fitted trading conditions like tight spreads, low fees & good spreads.

The trading platform is owned and operated by Hub Investments LTD, a financial service provider registered in Mauritius under registration number 176512 GBC.

Through the platform, traders can access 350+ underlying assets across six financial markets, including Forex, Commodities, Cryptocurrencies, Stocks, Indices and Metals.

Is ABInvesting Legit?

Yes, The broker is legit its parent firm is being regulated by various global regulatory bodies. The Financial Conduct Authority is one of the strictest bodies to impose strict rules when it comes to customer satisfaction.

The broker operates under the trading name of Hub Investments Ltd., a company regulated by the FCA (GB20025728). Also, Hub investments Ltd and FXBFI Brokers Financial Ltd are parts of the same companies, and together, the company is regulated by the FSC.

Almost all ABInvesting reviews on Trustpilot are good, so this is one more reason that this broker is absolutely legit.

ABInvesting Review: Pros & Cons:

Pros:

- Commission-free trading

- No minimum deposit

- A wide range of financial instruments

- Good and advanced platform.

- Segregated accounts for traders

- User-friendly interface

- Offers Demo Account

Cons:

- Does not provide MT5

- Does not accept clients from the USA.

Abinvesting Live Chart Feature

The ABInvesting live chart feature helps you analyze the past price trends of the currency. You can compare it with the current prices to make more informed decisions. The charting feature will let you access all the candlestick patterns, which gives near-to-accurate information about whether its a bearish or a bullish trend.

ABInvesting Trading Accounts Types

ABInvesting offers three main accounts including:

- Silver Account

- Gold Account.

- Platinum Account

Each account comes with a distinct set of features. For Instance, the Platinum Account offers a 50% swap discount, and the Gold account offers a dedicated account manager with trading available up to the 5th decimal.

The leading brokerage firm also offers a free demo account to its clients. With the help of a free demo account, traders can get familiar with the trading platforms and various global markets easily. Experienced traders can also get benefit from the demo account.

Let us look at these accounts in detail:

Silver Account:

This is the account type that is quite helpful for a novice trader. Leverage is maxed out at 1:125 for this silver account for trading in currency pairs. Leverage is considerably flat for this account, keeping in mind the novice traders.

- Max. Leverage: 1:50

- Min. leverage; 1:2

- Hedging: Allowed

- Zero Commission

- High-speed access to market movements

Gold Account:

This account is designed for people who have spent some time in the market and know-how market moves. The leverage offered is same in the gold and silver accounts. The Gold account features a dedicated account manager and a 25% Swap discount.

- Max. Leverage: 1:50

- Min. Leverage: 1:2

- Swap Discount: 50%.

- Hedging: Allowed

- Zero Commission

- High-speed access to market movements

- Free VPS

Platinum Account:

The Platinum Account is created for people who have known the markets for a long time. Seasoned traders enjoy almost every service that the financial service provider can possibly offer.

The clients are given the luxury of high leverage, free dedicated account manager with access to webinars and videos. It is quite different from the gold and silver account.

- Max. leverage: 1:500

- Min. Leverage: 1:2

- Swap Discount: 50%

- Hedging: Allowed

- Islamic Swap-Free Account

- Zero Commission

- Fifth Decimal

- Free VPS

- News Alert

- High-speed access to market movements

For those traders who desire to follow Shariah law, a highly customized account that adheres to Islamic norms is available in a form of an Islamic account. MetaTrader4, Mobile Application, and WebTrader platforms support 11 different languages, and customer service is available 24 hours a day, seven days a week.

Demo Account:

Demo accounts are so helpful because they allow you to try out new strategies or make modifications to your existing ones with no risk of losing money rapidly in the financial markets.

The best thing about this trading platform is that it offers a Demo account. Log in to your account and create a new one. Sharpen up your skills by utilizing them as much as possible.

A Demo account may also be used to gain a feel for how the trading platform works, how to place trades, and the types of conditions you would experience when you use a real account.

Islamic Account:

The brokerage trading platform offers Islamic account options to its retail and professional clients. It is a special account meant for traders who adhere to Islamic principles, with altered rules and no Swaps.

The core idea of Islamic trading process regulation is to avoid any potentially detrimental activity, such as interest-bearing investments and high-risk transactions such as margin and derivatives trading.

The unique Islamic account has no swap commissions, upfront fees, or interest costs. Furthermore, Fx traders get instant access to sophisticated analytical tools as well as over 350 CFD products. In addition, it allows for leverage of up to 1:400 and has no overnight fees.

How To Open Account With ABInvesting?

The account opening process on this brokerage platform is transparent and straightforward. All you need is a good internet connection and a web browser.

Follow this step-by-step guide to get started:

- First, visit the official website of the broker and click on sign up.

- After that, clients need to fill in their personal information like a bank account number, id proof, or address proof, and a strong password.

- When the primary documentation is complete, some more documents are required to be uploaded. For more details; Clients can visit the official web page of the broker.

- After completing this, Clients need to answer a questionnaire. This is because the broker needs to know the trader’s financial goals and look at the market knowledge they might hold.

Available Trading Platforms?

MetaTrader4 desktop and web-based platforms are the two best platforms available to users. The broker provides three different platforms according to different devices for trading; let us read about all of them in detail.

WebTrader

- Access to 350+ trading Assets.

- Wide range of technical analysis tools

- Ability to track trading history.

WebTrader comes with access to all the assets that the broker offers. The users also have access to more than 60 technical analysis tools that they can use to book every scrap of profit and analyze their strategies for the market.

WebTrader also comes with the functionality to view the trading history to take appropriate actions in the future.

MetaTrader4

MT4 is one of the most sought-after and simple trading platforms that will ever be built. ABInvesting offers the platform for traders majorly trading in currency pairs.

The MetaTrader4 platform is taken as the reference model for a lot of indigenous trading platforms that brokers build. The platform also offers nine-time frames for multi-timeframe analysis, interactive charts, take profit and stop-loss settings, and 60 technical analysis tools.

The pre-installed tools and indications assist you in doing a more precise, efficient, and effective analysis. MT4 platform also includes additional features.

Here are some key points about the MT4 trading platform.

- The trading environment can be customized to the max.

- Users have access to real-time price quotes.

- Trading can be done with one single click.

- Access more than 350 assets.

Mobile Application

The mobile app that the broker offers helps traders in accessing the MT4 platform. The only difference between the web-based platform and the mobile application is that the latter can be accessed from anywhere. This is especially good for active users.

The traders doing intraday need a better and a bigger screen because they need to be in the market for the whole day. The active traders, on the other hand, make a few trades every month. So, for that, a mobile app is a better choice.

Best Major Tradable Assets

The broker provides more than 350 CFD tradable assets for the users to take over the financial market. You can start trading with minimum capital in these tradable assets. Let us read about each of these assets in brief.

Forex:

ABInvesting claims to offer CFD trading on more than 45 Currency pairs, including exotic pairs like USD/GBP, USD/JPY, etc. Forex trading is all about liquidity and money-making. Currency trading can bring you what no other asset can.

- CFD on more than 45 currency pairs are available (major, minor, and exotic)

- There are no hidden costs or commissions.

- Market alerts and news in real-time

- Toolkit for professionals and analysts

- Access to free educational material

- Dedicated customer support and service

- Forex pairs include EUR/USD, USD/JPY, GBP/USD, EUR/JPY, EUR/USD, NZD/USD, EUR/GBP, EUR/CHF, EUR/USD, AUD/USD.

Cryptocurrencies:

ABInvesting offers more than 30 Cryptocurrencies that can be traded via its platforms. These cryptocurrencies are traded against fiat currencies, and that can itself be a Forex transaction of its kind.

The crypto market is volatile, and whenever that is the case, money-making becomes easy. Crypto trading is quite easy with ABInvesting broker.

- Professional 24/7 customer support

- Tighter Spreads

- There are no hidden costs or commissions.

- Price quotations and market data in real-time

- Exclusive educational content is available for free.

- Popular cryptos available include Bitcoin, Ethereum, ADA, and EOS, among others.

Indices:

More than 15 CFD tradable indices listed on the broker’s website are available for CFD trading. The list includes DAX 30, ASX 200, China enterprise 40, and a lot more.

- There are no hidden costs or commissions.

- Free educational hub

- Live multilingual support is available.

- Popular indexes include ASX SPI 200 Index Future (ASX), CAC 40 Index Future (Euronext), China H-Shares Index Futures (HKE), DAX 30 Index Future (Eurex), Dow Jones, DJ Euro Stoxx Index Future (Eurex), NASDAQ 100, and FTSE 100 Index Future.

Stocks:

The platform provides stock CFD trading on more than 140 stocks that include the blue-chips like Amazon and Apple. The traders can do stock trading without any commission and instantly execute their trades with the help of the broker.

- More than 150 CFDs on the most popular stocks

- There are no hidden costs or commissions.

- Market alerts and price changes in real-time

- Analytical toolset for professionals

- Price quotations and market data in real-time

- A free educational resource

- Dedicated customer service and support

- Google, Microsoft, Tesla, Zoom, and many others are among the most popular stock CFDs.

Commodities:

The brokerage platform offers trading opportunities in various commodity assets including both hard and soft commodities. You can trade crude oil, natural gas, and precious metals through a brokerage firm.

- CFD on more than 20 commodities

- There are no hidden costs or commissions.

- Market alerts and price data in real-time

- Analytical toolset for professionals

- Dedicated customer support

Fees, Commissions, and Spreads

The broker does not charge any commission when the traders buy or sell. Instead, it earns via spreads. The earnings are dependent on the financial market that the trader is trading on.

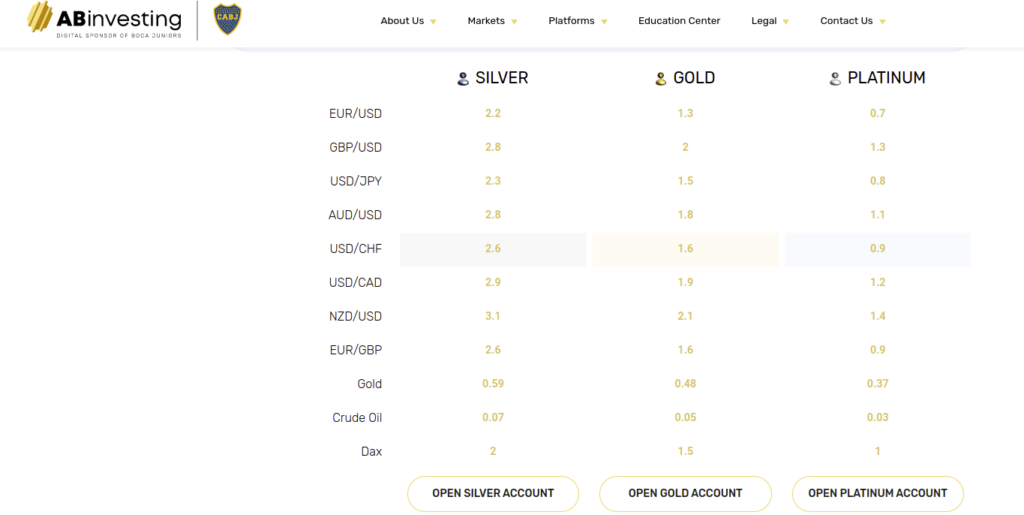

The spreads for the different retail accounts begin as follows:

- Silver Account: From 2.2 Pips.

- Gold Account:1.3 Pips

- Platinum Account: from 0.7 Pips.

The spreads are also variable depending on the asset that the trader is trading on. Let us have a look as to which asset is chargeable with how much spread.

The low spread while trading Forex is .03, and the highest spread charged is 3.1 In commodities, the highest spread is 0.59, and the lowest is 0.37.

Overnight Fees: On positions that remain open overnight (22:00) GMT, overnight financing or ‘swap’ costs are applied. On Wednesdays, a three-day swap charge will be applied to positions held over the weekend.

However, clients with an Islamic account will not get or pay interest on any overnight holdings.

Inactivity fee: Inactivity fee will be imposed on the account if there has been no trading activity for at least 60 days.

Maximum Leverage

The brokerage offers leverage for different accounts and assets. The leverage is continuously variable according to the different financial markets. Two accounts or two same asset classes will never have the same leverage.

For Instance, the traders trading in Forex, using the silver account, can use 1:125 leverage, and the traders with the platinum account can use 1:500 maximum leverage.

Retail investor accounts lose money rapidly due to leverage. It has to be kept in mind that leverage is a two-edged sword and will only amplify what is already there.

How To Deposit and Withdrawal Funds?

The broker charges zero commission on deposits or withdrawals. The process is quite simple, hassle-free, and fully digital. The client has to click on the deposit button to add funds and withdraw to take them out.

There are no fees for depositing funds, and payments using credit/debit cards, Bank/wire transfers, and e-wallets are usually processed immediately. Similarly, the funds can be withdrawn by choosing available Withdrawal methods.

There is no withdrawal fees charged by the platform. However, Inactivity/dormant account fees will be imposed if there has been no trading activity for at least 60 days.

There are various payment options by which the traders can withdraw or deposit funds:

- Neteller

- Skrill

- Credit card

- Debit card

- Bank / Wire transfer

Withdrawals may take 1 to 3 business days, depending on the bank

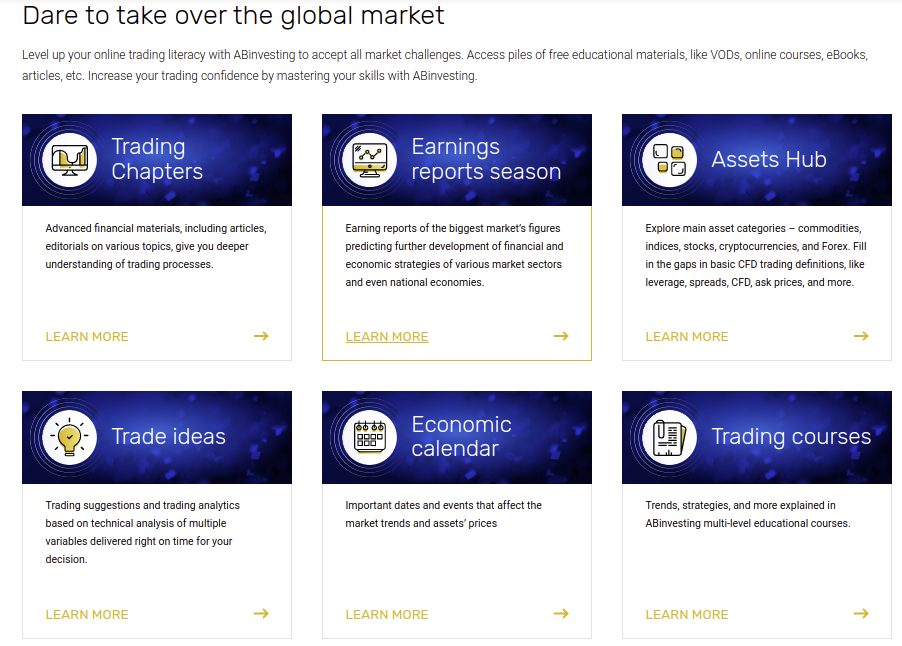

Education and Research Material:

Educational videos, eBooks, seminars, and tutorials are just a few of the educational tools available for ABInvesting clients. The information provided is extensive, covering everything from the fundamentals of trading to economics, forex trading indicators, and even trading psychology.

The training content is of great quality, and the webinars cover a wide range of topics, making them suited for both beginners and advanced traders.

The Signal centre, one of the most innovative features, helps investors catch trading signals for Forex. The Signal centre can also be used for the commodity market, indices, and a lot more.

Through the Signal Centre, the platform gives clients access to research, which includes trading signals on the Forex, Commodity, and Index markets. Clients can access learning material through the website’s Education area, and while registration is required, only basic information such as name, phone number, and email are required.

The brokerage company also provides different types of research-based education material trading tools that the traders and investors can look up to for further use.

The educational material comes in the form of:

- Webinars

- Articles

- On-demand videos

- Economic calendar

- Season’s calendar.

Customer Support

The customer support service team available on the brokerage platform is multilingual, helping traders and investors all across the globe. The customer support representatives are well versed in the conducted business.

The customer assistance service is available in multiple languages including, English, Spanish, Latin American, etc. Common questions about registration, trading and the Verification Process are also pre-set, with detailed answers available via the live chat feature.

Contact Information:

- Email: [email protected]

- Phone: +441214682461

- Address: FSC House, 54 Cybercity Ebene, Republic of Mauritius.

- Live Chat

Conclusion:

Before someone can call himself a successful trader, they must have the necessary abilities, knowledge, and often years of experience and losses. The broker provides all of the services and features that traders require in order to participate in the financial market and profit. When it comes to trading, ABinvesting effectively provides novice traders with a handful of learning material right from the beginning and better customer support.

ABinvesting is licensed and adheres to all safety precautions to protect the trader’s funds and data safety. However, that is the fundamental method where ABinvesting distinguishes itself from the competition.

In addition, the broker’s instructional and research area is pretty outstanding in terms of assisting traders in making profitable trading decisions.