PrimeFin is a global multi-asset trading platform that allows users to trade CFDs on all popular financial instruments. It is a well-regulated broker with over 2 million registered users worldwide. Let’s understand more about the platform with this updated PrimeFin Review 2023.

The brokerage claims to offer world-class trading services to its users. And after analyzing the platform deeply, the claims seem to be true to a great extent. Additionally, PrimeFin’s regulation and transparency offer the best fund protection to traders.

You will find a good range of available account types, including unlimited demo and Islamic accounts. Let’s move further with this in-depth PrimeFin review to analyze the platform on the basis of the fees, the spreads, the offer of trading assets and the traders’ experience.

PrimeFin Review: At A Glance

| Official Website | www.primefin. com |

| Headquarters | Malaysia |

| Regulators | LFSA |

| Minimum Deposit | $250 |

| Trading Platforms | WebTrader, MT4 & PrimeFin App |

| Supported Instruments | Forex, Commodities, Stocks, Indices and Cryptocurrencies |

| Customer Support | 24×5 via Live Chat & E-mail |

What Is PrimeFin?

PrimeFin is a leading financial service provider offering to trade 350+ underlying financial instruments through its advanced trading platforms. The brokerage is owned and operated by Caps Solutions Ltd, a firm incorporated under the laws of Labuan, Malaysia. At the same time, PrimeFin is the digital sponsor of the Argentine National Team.

The main goal of this global brokerage firm is to provide clients with a quick and smooth trading experience. While analyzing this detailed PrimeFin Review, we found it to be offering a long list of financial assets across all major markets, including Forex, cryptocurrency, stocks, commodities, market indexes, and precious metals.

The broker has quickly risen to the top of the market thanks to its exceptional trading services, including:

- Cross-functional trading platform

- Multi-device trading apps

- Instant execution

- Substantial educational hub

- Quick withdrawal

- Top-notch data protection

Is PrimeFin A Scam?

No, PrimeFin is not a scam in terms of regulations. The platform holds a tier-1 license from the Labuan Financial Services Authority (LFSA). As a top-tier regulatory license holder, we can put PrimeFin on a list of legit and regulated brokers.

At the same time, the platform is owned by Caps Solutions Ltd, a reputed financial services provider registered in Labuan with reg no LL16622 and license number 12734767.

Meanwhile, the broker’s European entity- Caps Solutions UK Ltd, is located at Almack House, 26-28 King Street, London, England (UK), and serves as the broker’s payment processor.

Furthermore, the broker adheres to all financial authorities’ rules and regulations, such as the EU, MiFID, and Investors Compensation Funds (ICF), which operate in the client’s best interests and safeguard them against any potential fraud.

Considering these above-mentioned points, you can rest assured that PrimeFin is a legit forex & CFD broker, and rumors regarding it being a scam are fake and worthless.

PrimeFin Review 2023: Pros And Cons

Through this PrimeFin review, let’s have a quick overview of the broker with its advantages and drawbacks. Consider them thoroughly to determine whether the platform is worth your deposit.

| Pros | Cons |

| No minimum deposit | No MetaTrader5 |

| 350+ Trading Instruments | |

| Cross-functional platform | |

| Multi-device trading apps | |

| Advanced Educational Support | |

| Offers Crypto trading | |

| Tight spreads for live trading accounts | |

| Islamic Account option |

PrimeFin Review: What Are Available Account Types?

The platform provides a good account offering with three retail accounts, an Islamic and a free demo trading account. The features and the spread charges of each account type vary. So, let’s take a quick overview of each account’s features and see what it has to offer:

| Features | Silver | Gold | Platinum |

| Hedging | Allowed | Allowed | Allowed |

| FX leverage | 1:100 | 1:100 | 1:100 |

| Dedicated account manager | Yes | Yes | Yes |

| Spreads | 0.07 | 0.20 | 0.03 |

| Customized investment news | Yes | Yes | Yes |

| Free VPS | No | Yes | Yes |

| Fifth decimal | No | Yes | Yes |

| Swap discount | No | 25% | 50% |

| Base Fiat Currencies | EUR/USD, GBP/USD, USD/CAD, USD/JPY | EUR/USD, GBP/USD, USD/CAD, USD/JPY | EUR/USD, GBP/USD, USD/CAD, USD/JPY |

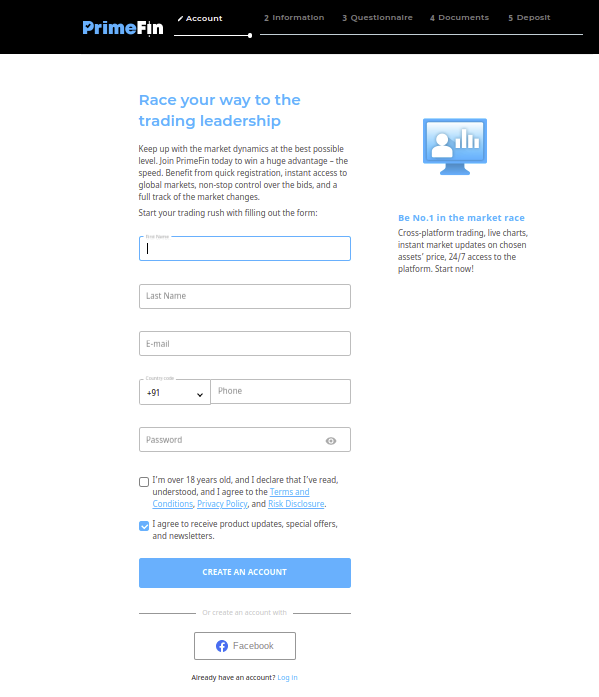

How To Open An Account With PrimeFin?

The account opening process on PrimeFin is really the easiest one compared to other brokers we have reviewed so far. The process includes just 5 steps, and voila! You can start trading on the platform.

- Account Registration

- Information

- Questionnaire

- Document Verification

- Deposit

First, click on the ‘Open Account’ icon on the broker’s website, through which you’ll be redirected to the account opening application page. Traders can also access the account opening page by clicking on the link on the account details page.

Here are the simple steps that you can follow to open your PrimeFin trading account:

- Firstly, you’ll need to provide personal information such as your first and last names, email addresses, country codes, phone numbers, and passwords. After you’ve filled out these fields, click the ‘Create Account’ button.

- Now, fill out the information about your trading requirements and account type. After that, click the submit button to proceed to the next page.

- You’ll be asked questions about your prior trading experience. Before moving on to the document page, ensure all the information is correct.

- Now, follow the directions on the website page to submit your documents.

- The final step is to make a minimum deposit into your chosen account, which is $250.

PrimeFin Review: List Of Available Trading Instruments

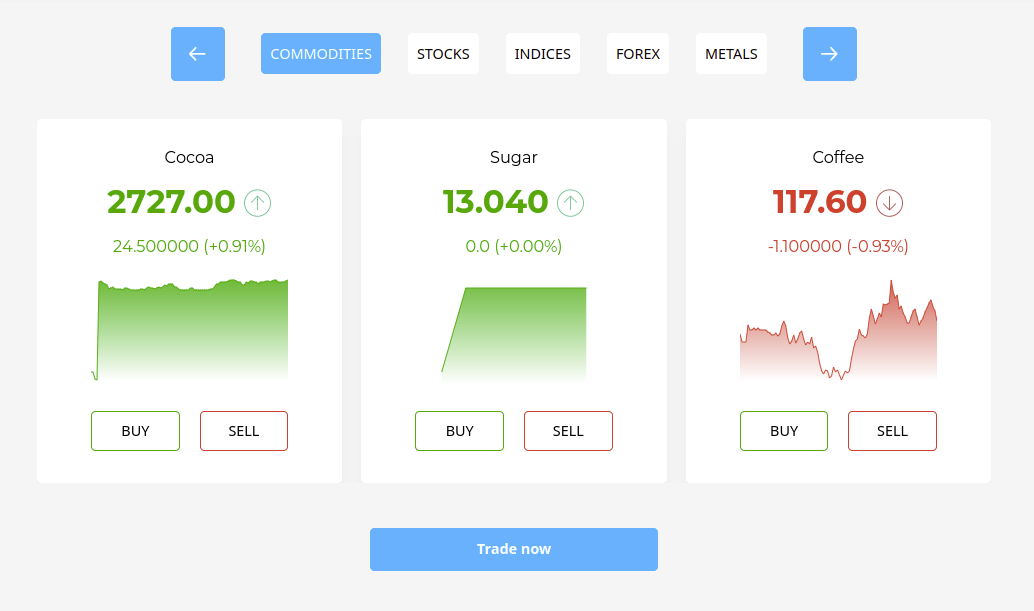

PrimeFin offers CFD trading on six major market instruments, including Forex, Crypto, Stocks, Indices, Precious Metals, and commodity trading. Each trading asset’s market standing and prices are well-defined on the platform.

Through this detailed primeFin review 2023, let’s have a look at the available trading markets:

Foreign Exchange (Forex)

With PrimeFin, you can trade more than 40 forex currency pairs. All minor, major, and exotic currency pairs are available, including NZD/USD, EUR/GBP, CAD/NZD, and USD/EUR.

Stock Trading

The platform allows trading CFDs on a wide range of stocks of small to large-cap companies. For example, you can trade CFDs on stocks like Apple, Google, Facebook, Amazon, and more.

Indices Trading

Indices are the basket of domestic and US stocks. With this platform, you can start trading CFDs on the most popular indices and actual stock market indexes, including Dow Jones Industrial Average, Nasdaq, FTSE 100, S&P 500, etc.

Cryptocurrency Trading

CFDs on various popular cryptocurrencies are available. The broker offers Bitcoin, Ethereum, Polkadot, and more. Trading in crypto involves high risk, so make your decisions wisely.

Commodities Trading

Both hard and soft commodities are available for trading on this brokerage platform. You can trade CFDs on livestock and agricultural products like meat, pork, wheat, sugar, soya, and more.

Metals Trading

You can start trading CFDs on metals like silver, gold, platinum, and other precious metals.

PrimeFin Fees, Commission and Spreads

The best part of using PrimeFin services is that it is a commission-free broker; however, there are spread charges that vary depending on the instrument. Spreads are determined by three key factors: Account types, Assets traded, and Market conditions.

| Account Types | Spreads | |

| Minimum | Maximum | |

| Silver | 0.07 | 0.600 |

| Gold | 0.20 | 0.550 |

| Platinum | 0.03 | 0.500 |

PrimeFin Review: Maximum Leverage

For all three accounts, the broker offers maximum leverage of 1:100 and a minimum of 1:2. As per our review of the PrimeFin trading platform, the leverage offering seems to be the best in the industry.

Here’s the maximum leverage offered in various assets classes:

- Forex: 1:100

- Metals: 1:25

- Indices: 1:25

- Commodities: 1:25

- Stocks: 1:10

- Crypto trading: 1:2

PrimeFin Review: Deposits And Withdrawal Methods

Unlike many CFD brokers, PrimeFin supports plenty of payment methods for funding and withdrawing from the account. The available payment methods can be used for depositing and withdrawing funds. Here’s a list of available payment methods:

- Skrill

- Neteller

- Bank wire transfer

- MIR Limited

- Safecharge

- Orange Pay

How To Deposit Funds Into PrimeFin Account?

The funding process of the platform is quick and easy. It takes a few seconds to make a payment and only 2-3 minutes to reflect it into your account. Here’s a complete process:

- Login into your account and tap on the dashboard.

- Now, click on the deposit icon. Now, enter the amount and click on the continue button.

- Select your preferred payment method, and follow the on-screen instructions to complete the transaction.

How To Withdraw Money From PrimeFin?

You can raise the withdrawal request on PrimeFin anytime, anywhere. The average processing time for a withdrawal request is 3-5 days. However, in most cases, it may process the same day. Follow these steps to raise a PrimeFin withdrawal request:

- Sign into your account on the PrimeFin login page.

- Now, click on the ‘Withdraw’ icon. Now, enter the amount and click on the continue button.

- Select your preferred payment method, and follow the on-screen instructions to complete the transaction.

PrimeFin Review: Trading Platforms Reviewed

PrimeFin provides innovative and popular trading platforms for web and mobile trading. The complete trading experience is equipped with simple, structured tabs and navigation systems with classified functionality.

Here’s a deep look at the available trading platforms:

WebTrader

Traders can access global markets from any device or browser without downloading any additional software. The multi-asset trading platform WebTrader also includes one-click trading, multiple trade execution modes, an analytical toolbox, and a historical record in the huge financial market of Forex and CFDs trading.

- Automatic Stop Loss/Take Profit functions to minimize your high-risk chances.

- Free learning center

- Real-time balance level

- In-platform costs alerts

- Multiple chart windows

- One-click account switching

- Inherent platform support

- Live chat

- Dedicated customer support

MetaTrader4 (MT4)

MetaTrader4 (MT4) is traders’ most recommended and popular trading platform. It is well-known for its built-in features, including high execution speed, multiple trade execution modes, an analytical toolbox, and order history.

Traders can access this platform via mobile, laptop, or PC. The MetaTrader4 trading platform supports both Android and iOS. In addition, traders can use any browser to access this trading platform. The platform also helps traders in building good trading strategies.

- Real-time balance level

- Multiple chart windows

- In-platform costs alerts

- Automatic Stop Loss/Take profit functions

- One-click account switching

- Inherent platform support

- Free learning center

- Live chat and dedicated customer support.

- High execution speed

Review Of PrimeFin Mobile App

PrimeFin has its own mobile application that allows you to trade nonstop, receive custom notifications on specific assets, execute orders quickly, and track price changes and speculation.

Features of the PrimeFin app include:

- High-frequency trading

- Automatic Stop Loss/Take Profit functions

- In-platform price alerts

- Efficient sweep & trade user experience

- Real-time balance level

- 1-click trading operations and account switching

- Free learning center

- Live chat and multilingual support

- Available on both iOS and Android

How To Download PrimeFin App?

To download the PrimeFin mobile application, follow these steps:

- Firstly visit the official website and click on the ‘Platforms’ icon.

- Now, select Mobile App. A new page will open on the screen.

- Choose between the iOs and Android device; your download will start soon.

- Alternatively, you can directly search for “primeFin App’ on Play Store or App Store and download it from there.

PrimeFin Review: Educational And Research Support

The broker offers a substantial educational hub, including articles, webinars, videos, trade ideas, VODs, and so on, which is an appreciable move. You can develop and improve your knowledge and furnish trading skills to develop a trading pace with the help of these educational resources.

Experienced traders can use these materials to keep up to date on new market trends, while new traders can use them to learn about techniques and market behaviour.

In addition to educational offerings, the platform also offers a variety of research trading tools that allow users to analyze and test their trading strategies in order to make more practical trades. The broker provides two advanced trading tools: an Economic Calendar and a Market Calendar. Economic calendars are used to keep track of financially problematic occurrences.

PrimeFin Customer Support Reviewed

PrimeFin’s customer support is exceptional, with a team of experts ready to answer all customers’ queries. However, one thing that needs improvement is its limited 24×5 support. In order to become a prominent market player, PrimeFin should extend its customer services to 24×7. Overall, our experience was good, and we tried contacting them through all three available channels. And they all were working.

If you’d like to speak with the management, you can use the Contact Management option on the contact us page on the website. Here are the contact details:

- Registered Address: Almack House 26-28 King Street, London, England (UK)

- PrimeFin Contact Number: +44 1215120156 +27 418800785 +66 25060038

- Email: [email protected]

What Are The Best PrimeFin Alternatives?

While primeFin services are the best in the industry, still we have found the 3 best alternatives of the platform. Take a quick comparison between them.

PrimeFin vs Capitalix

| Features | PrimeFin | Capitalix |

| Regulation | LFSA | FSA |

| Minimum Deposit | $250 | $250 |

| Fees/Spreads | 0.03 | 0.05 |

| Leverage | 1:100 | 1:200 |

| Demo Account | Available | Available |

PrimeFin vs InvestBy

| Features | PrimeFin | InvestBy |

| Regulation | LFSA | NBRB |

| Minimum Deposit | $250 | $250 |

| Fees/Spreads | 0.03 | 0.07 |

| Leverage | 1:100 | 1:200 |

| Demo Account | Available | Available |

PrimeFin vs ABInvesting

| Features | PrimeFin | InvestBy |

| Regulation | LFSA | FSC |

| Minimum Deposit | $250 | $250 |

| Fees/Spreads | 0.03 | 0.07 |

| Leverage | 1:100 | 1:500 |

| Demo Account | Available | Available |

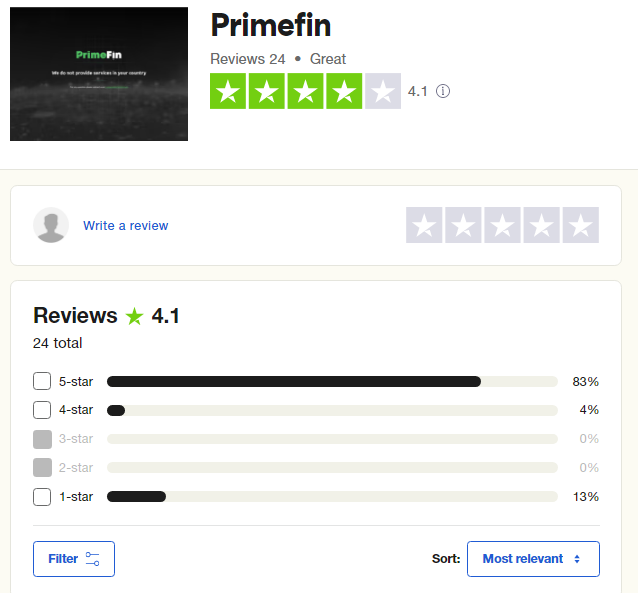

PrimeFin Reviews & Users’ Ratings

The platform has a good reputation among its existing users. It has got 4.1 stars out of 5 on Trustpilot, which speaks a lot about it popularity and market standing. Most of the users are happy with the services.

Final Verdict

The PrimeFin review explains some of the top features and reasons why choosing this platform can e a good choice for you. Moreover, the high leverage and low spread offerings are what every trader search for in a platform.

The zero commission charges, free demo account and good customer support are the cherries on top. Overall, the PrimeFin review clearly indicates why it is emerging among the best forex brokers in the world.