Introduction

FXCM (Forex Capital Markets) is a forex broker now headquartered in London, UK. The company was banned in the U.S. due to allegations of fraud, leading to Global Brokerage, Inc., its former parent company, filing for bankruptcy in late 2017.

Presently, FXCM is under the ownership of the esteemed Jefferies Group, formerly known as Leucadia National Corporation. The brokerage operates under the oversight of various regulatory bodies, including the Financial Conduct Authority (FCA) and the Australian Securities & Investment Commission (ASIC).

Overview of FXCM

| Broker Name | FXCM |

| Website | www.fxcm.com/ |

| Headquartered | London, UK |

| Founded In | 1999 |

| Regulation | FCA, ASIC |

| Minimum Deposit | $50 |

| Trading Assets | Indices, Shares, Forex, Cryptocurrencies, Commodities, and Spread Betting available for UK and Ireland residents |

| Demo Account | Available |

| Trading Platforms | MT4, ZuluTrade, Trading Station, Ninja Trader, TradingView, Capitalise AI |

| Leverage | 1:200 | 1:30 |

| Spreads and Commissions | 1.3 pips |

| Base Currencies | USD, GBP and EUR |

| Customer Support | 24/5 |

What is FXCM?

FXCM is an online brokerage firm founded in 1999 in London, UK. The broker is regulated by two stringent regulatory authorities, the Australian Securities Investment Commission and the Financial Securities Commission.

The broker has a company known as Stratos Markets Limited, operating as a subsidiary within the FXCM group of companies (collectively called the “FXCM Group”), and is authorised and regulated by the Financial Conduct Authority in the United Kingdom.

It holds registration number 217689 and is officially registered in England and Wales with Companies House under the company number 04072877. Any mentions of the “FXCM” website pertain to the FXCM Group.

Is FXCM a Scam?

No, FXCM forex broker does not come out as a scam. The broker is stringently regulated by Tier-one authorities, ASIC and FSA.

- The Financial Conduct Authority (FCA) oversees regulatory compliance in the United Kingdom. 217689

- FXCM Australia Pty. Limited operates under the regulatory authority of the Australian Securities and Investments Commission. 309763

- FXCM EU LTD holds authorisation and regulation from the Cyprus Securities and Exchange Commission (CySEC). 392/20

- FXCM South Africa (PTY) LTD is subject to regulation by the Financial Sector Conduct Authority. 46534

FXCM encountered significant challenges, particularly during the unexpected move by the Swiss National Bank (SNB) in 2015, when it lifted the peg on EUR/CHF. This unforeseen event led to a substantial loss for the company. Despite these setbacks, FXCM has successfully recovered and is presently under the ownership of Jefferies Financial Group, a financial services powerhouse boasting assets exceeding $51 billion.

In 2017, FXCM forex broker was banned in the US due to allegations of fraud. Global Brokerage, Inc., the former parent company of FXCM, filed for bankruptcy in late 2017.

According to the latest news in the market, the broker has now come back on track and has been working somewhat in the business.

Subsidiary Services By FXCM

FXCM forex broker extends its brokerage services to customers through partners and affiliates in key international financial centres. These include:

London, UK: Forex Capital Markets Limited (“FXCM LTD”)

Sydney, Australia: FXCM Australia PTY Limited (“FXCM Australia”)

Paris, France: Forex Capital Markets Limited (“FXCM France”)

Hong Kong: FXCM Bullion Limited (“FXCM Hong Kong”)

FXCM trading also caters to other established and developing economic regions and requires its local partners in these areas to comply with all relevant local regulations:

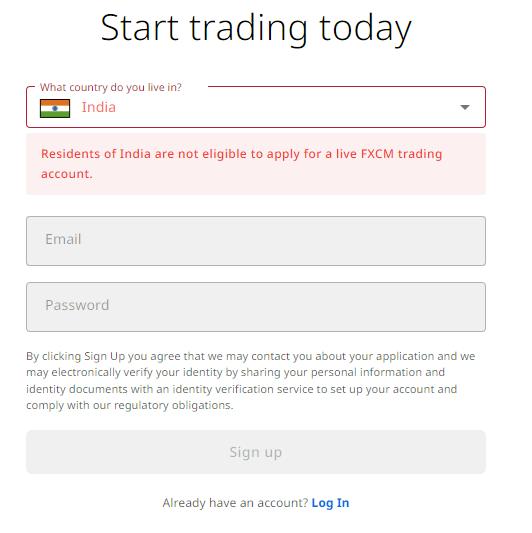

India: FXCM Markets

South Africa: FXCM South Africa (PTY) LTD

Available Trading Assets At FXCM

FXCM offers various trading assets for traders

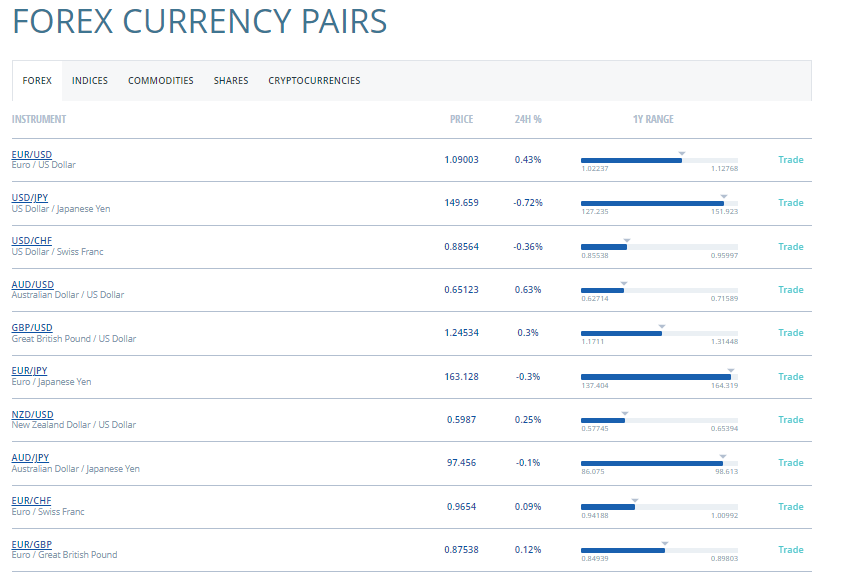

Forex

Traders can trade forex with leverage up to 1000:1. The deep liquidity ensures seamless entry and exit from trades, even when dealing with substantial amounts, offering flexibility and accessibility at any given moment.

Majors: EUR/USD, USD/JPY, GBP/USD, USD/CHF

Commodity Pairs: AUD/USD, USD/CAD, NZD/USD

Shares

International share CFDs from the US, UK, HK1, AU, and Europe with minimal margin requirements, enabling trade with greater flexibility. It’s crucial to remember that margin trading involves risks, potentially amplifying losses. A mere 20% margin is needed to enter the market, but caution and prudent risk management are advised.

- Tesla

- Amazon

- GameStop

- Apple

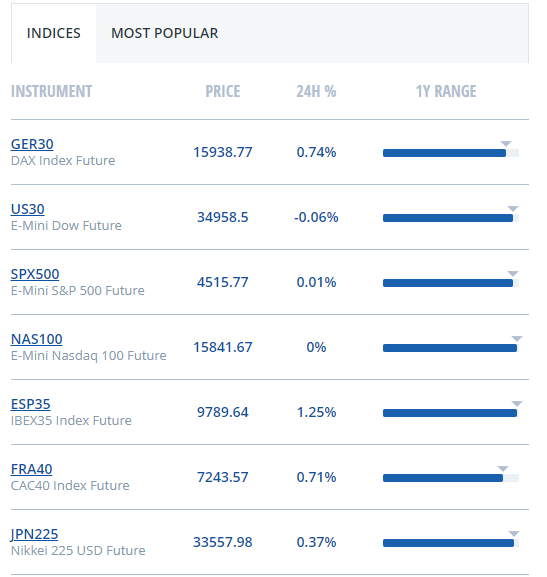

Indices

Traders can trade the most popular indices in the world with huge potential of profits.

- GER30

- US30

- SPX500

- NAS100

Short Trading

CFD traders can take both long and short positions with a straightforward click of a button, allowing them to speculate on both the upward and downward movements of indices.

Commodities

Traders can trade with the most popular commodities with FXCM.

- US Oil

- UK Oil

- XAG USD

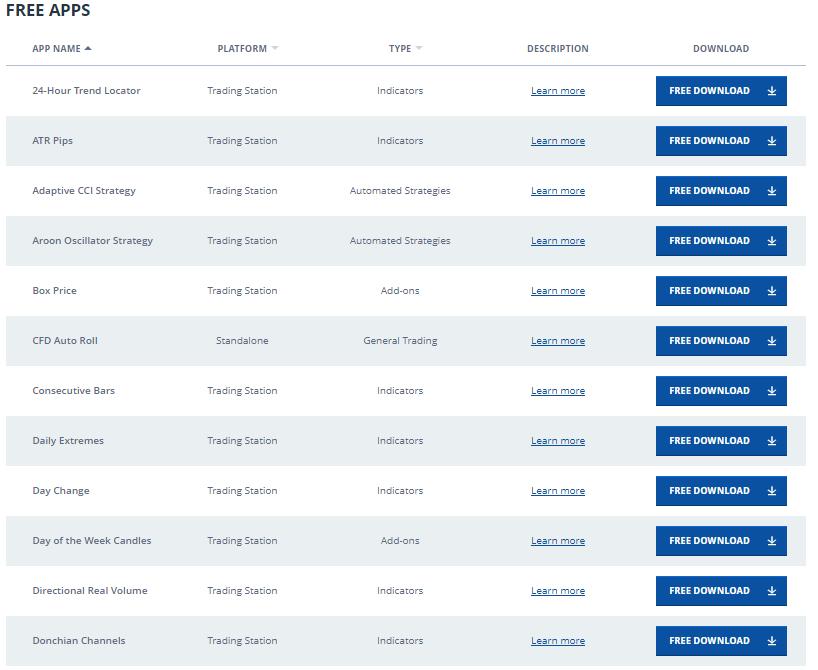

Trading Platforms At FXCM

FXCM offers several platforms for trading

Trading Station

- Enjoy up to a 54% reduction in spreads on major currency pairs.

- Access a comprehensive platform that covers Forex, Stocks, and Indices CFDs.

- Experience a trading environment that is fast, reliable, and user-friendly.

Trading View

- Trade Forex and Gold within a single account.

- Experience narrow spreads, such as 1.82 for GBP/USD.

- Enjoy leverage of up to 30:1 on major currency pairs.

- Facilitate easy funding through options like Credit & Debit Cards and online bank transfers.

MetaTrader4

- Establish SL/TP Pre-Execution: Set Stop Loss and Take Profit orders while initiating a new trade.

- 0.01 (Micro) Lots: Engage in trading with more precise lot sizes for enhanced risk management.

- Partially Close Positions: Exercise control over when and to what extent you wish to close a position.

Capitalise AI

- Historical Testing: Employ past data to observe the actual performance of your strategy.

- Simulation: Safely assess your strategies using real-time data without financial risk.

- Performance Metrics: Extract valuable insights from detailed and comprehensive statistics for each trade.

- Quick Adaptation: Modify your strategies based on their performance swiftly with a simple click.

FXCM Mobile App

The Trading Station mobile and MT4 combination offers a robust mobile trading experience, enriched with features such as a comprehensive trade ticket that facilitates one cancellation of other (OCO) orders. You can download the FXCM app from the app store.

Account Types Offered By FXCM

FXCM provides a unified commission-free account for both Forex and CFD trading. For those opting for higher minimum deposits, the Active Trader Programme becomes available, offering monthly rebates corresponding to the trading volume.

Supporting MT4 and Trading Station platforms alongside Zulutrade, FXCM accommodates diverse trading strategies, including hedging, scalping, and copy trading. Additionally, the platform extends Islamic swap-free accounts.

The Standard Account, with a minimum deposit of 50 USD, is tailored to cater to the needs of novice traders, ensuring accessibility.

ZuluTrade

FXCM extends ZuluTrade, a social and copy trading platform that enables users to replicate the trades of professional traders in real time. This platform facilitates instant copying of trades, allowing users to stay in sync with the actions of experienced traders. Furthermore, users have the option to leave comments and engage in communication directly within the platform.

Demo Account

The broker offers a free Demo Account for novice traders in the industry. The Demo Account of FXCM has 5000 USD virtual money and expires after an inactivity of 30 days.

Islamic Account

FXCM provides an Islamic, Swap-Free trading account free from roll-over fees. FXCM automatically extends Swap-Free status by default to all eligible trading accounts created by clients in non-Islamic countries.

How To Open an Account on FXCM

STEP 1. Click on Open An Account in the blue tab on the website.

STEP 2. Select your country of residence plus your preferred platform for trade.

STEP 3. Complete a selection of general information, including your preferred account option.

STEP 4. Complete a Personal Information section, including date of birth and more.

STEP 5. Fill in contact and employment information

STEP 6. A final set of questions will be related to security measures and a referral.

STEP 7. Go through the terms and conditions carefully, and then you are ready to go.

FXCM Log in

You can log in to your FXCM trading account after successfully registering.

Pros and Cons of FXCM

Here are some advantages and disadvantages of FXCM

| PROS | CONS |

| Low minimum deposits. | Banned from US markets for fraudulent activities |

| The convenience of mobile trading and one-click order execution. | Only one account type is offered to the customer |

| Trading of minor, major and exotic currency pairs | Lack of information on the website related to accounts |

| Neat User Interface | Customer Support only 24\5 |

| Account setup is easy |

Leverage

FXCM’s leverage levels are determined by a combination of the trader’s account funds and the specific regulatory requirements based on the residence or account jurisdiction. The leverage levels are as follows:

- 1:30 for Australian clients

- 1:30 for UK and Europe

- 1:100 for clients in South Africa

Fees, Spreads and Commission

FXCM trading entails

- Fees start from $50 / R750 ZAR,

- Spreads ranging between 0.2 pips to 1.3 pips

- Commissions that vary based on the chosen account type.

- A minimum deposit fee of $50 / R750 ZAR is also applicable.

Deposits and Withdrawals at FXCM

There are several options with FXCM when it comes to Deposits and Withdrawals

Deposits

Bank Wire Transfer: Fund your FXCM trading account by directly transferring funds from your bank account to FXCM’s bank account. Known for reliability, although the funds may take some time to reflect in your trading account.

- Debit/Credit Cards: FXCM typically accepts major credit and debit cards such as Visa and MasterCard. Deposits via cards are quickly processed.

- Online Payment Services: Some online payment services like PayPal, Skrill, and Neteller may be accepted for depositing funds. Recognised for their convenience and speed.

- Checks: In some instances, you may have the option to fund your FXCM account using checks. However, this method may take time to process.

Withdrawals

Bank Wire Transfer:

- Withdraw funds from your FXCM account to your bank account through wire transfer.

- Commonly used for withdrawing large amounts.

Debit/Credit Cards:

- Allow withdrawals to the same card initially used for depositing funds up to the deposited amount.

- Any additional funds are typically withdrawn through alternative methods.

Online Payment Services:

- If funds were deposited via services like PayPal, Skrill, or Neteller, withdrawals can usually be returned to the same account.

Checks:

- FXCM may offer the option to issue a check for your withdrawal.

- This method may involve longer processing times due to postal delivery.

ACH (Automated Clearing House) Transfer:

- For users in the United States, there may be an option to withdraw funds via ACH transfer.

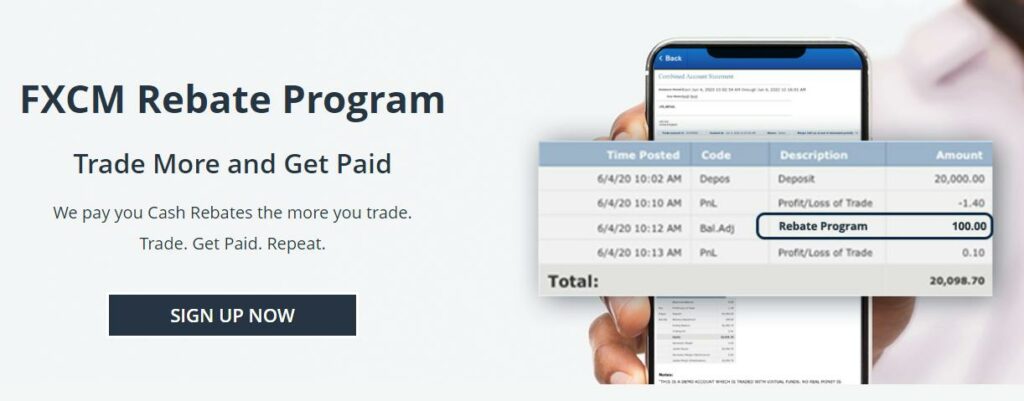

FXCM Rebate Program

Traders can get different tier rebates based on the volume they trade.

REQUIREMENTS:

- Open an account on FXCM

- Meet a minimum notional volume requirement of USD 10 Million every month

Friends and Family Referral Programme

Friends and family members receive the same bonus by opening an account, funding it with a minimum of $300, and meeting the specified trading volume criteria.

How can you refer?

- Maintain an active trading account with FXCM.

- Enrol in the promotion by completing the Friends and Family Referral form on the right.

- Encourage your friend to open an account here, ensuring they include your email address in the referral designation field of the application form.

- Receive rewards once your referrals fulfil the necessary trading volume within 90 days of account activation.

Account Promotions

As an engaged participant in the financial markets, you can receive Cash Rebates based on your trading volume at FXCM trading.

FXCM vs Oanda

Here is a comparison between FXCM and Oanda

| Broker | FXCM | Oanda |

| Regulation | FCA, ASIC, FSCA | CFTC, FCA, NFA, ASIC, IIROC, JFSA, MAS |

| Type of Broker | No Dealing Desk, Dealing Desk | Market Maker |

| US Clients Allowed | No | Yes |

| Islamic Account | Yes | No |

| Assets offered | 69 | 124 |

Alternatives To FXCM

Here are some reliable and trustworthy brokers with a clean history in the trading world.

(Equiity, TradeEU.com, Capitalix, RCG Markets, Mether World)

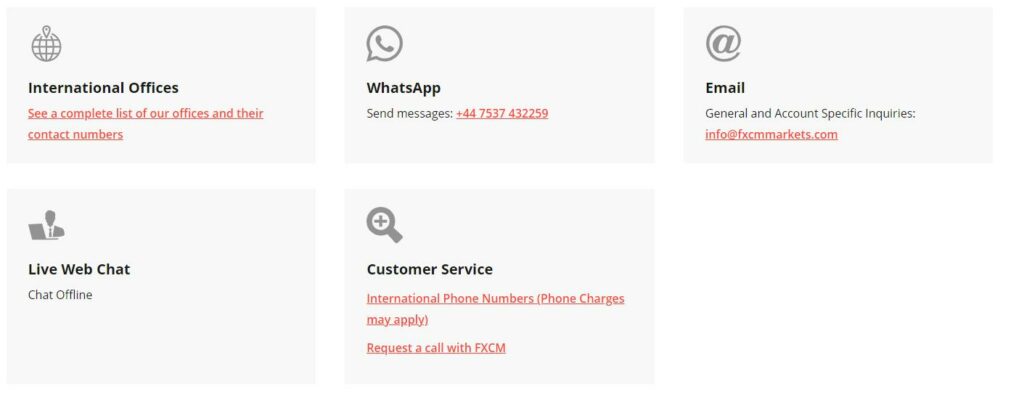

Customer Support

In our recent assessments, FXCM’s customer support exhibited a varied performance. Across phone, chat, and email inquiries, there were instances of wait times before receiving responses.

When using the phone service, notable wait times were experienced; however, the agents demonstrated knowledge and provided helpful assistance.

On the chat platform, a notable drawback was the requirement to fill out a form before connecting with an agent. Live chat availability was intermittently offline during certain periods throughout the week.

LiveChat

Phone Number: 0808 234 8789

Email Id: [email protected]

Whatsapp Number: +44 7537 432259

Social Networking Platforms: Facebook, Twitter, RSS Feed and YouTube

Conclusion

FXCM provides trading options with an average range of tradable assets compared to peers. Noteworthy strengths lie in the platform choices, the range of trading tools, and the quality of the educational materials. It’s crucial, however, for traders to be mindful of elevated non-trading costs, encompassing withdrawal fees, inactivity charges, currency conversion fees, and interest levied on negative accounts.

This is particularly relevant for Indian traders without negative balance protection and limited control over leverage levels in their accounts.