Introduction

Alpha Markets is a relatively new broker in the industry, founded in 2022 in Cyprus. The broker is not regulated and thus raises concerns about the safety of funds of the clients. We have curated detailed facts about the broker in this review. Read and learn if the broker is safe for you.

| Broker | Alpha Markets |

| Website | www.alphamarkets.io |

| Registered Country | Cyprus |

| Founded In | 2022 |

| Regulation | Not Regulated |

| Minimum Deposit | $5 |

| Maximum Leverage | 1:500 |

| Spreads | Starting from 0 Pips |

| Trading Platforms | MetaTrader5 |

| Trading Assets | Precious Metals, Equity Indices, Energies, CFDs of Commodities and Stock |

| Demo Account | No |

| Islamic Account | No |

| Payment Methods | PayPal, MasterCard, Ozow, EFT, Wire Transfer |

| Customer Support |

What is Alpha Markets?

Alpha Markets is an online brokerage firm recently founded in Cyprus. Alpha Markets broker is not regulated, but the parent company based in South Africa, Pal Life (Pty) Ltd, is regulated by the Financial Sector Of Conduct Authority.

This somehow shadows the real point of the broker being regulated, not just one of the companies it works under.

It is essential and recommended that Alpha Markets own a legitimate license from a stringent regulatory authority. The traders are advised that they should deal with a broker with a regulatory license; one of these trusted brokers is RCG Markets.

Alpha Markets: A Scam?

AlphaMarketsSA, registered as Alpha Markets SA (Pty) Ltd in South Africa under registration number 2022/550358/07, serves as the duly appointed juristic representative of Pal Life (Pty) Ltd, South Africa, bearing company number 2020/577727/07. Pal Life is an authorised financial services provider, licensed and regulated by the Financial Sector Conduct Authority (FSCA) in South Africa, with FSP No. 43259.

Alpha Markets SA, functioning as a juristic representative of Pal Life (Pty) Ltd, is the designated platform for Clients to engage in derivative trading. These derivatives are issued by Neo Brokers Namibia (Pty) Ltd, a company situated and operational in the Republic of Namibia, identified by company number 2022/0418 and a registered address at 19 Palladium Street, Prosperita, Windhoek, Namibia.

Neo Brokers Namibia acts as the counterparty and principal in the contract for the difference purchased by you (the Client).

In its role as a juristic representative of Pal Life (Pty) Ltd, Alpha Markets SA serves as the intermediary and facilitator between you (the Client) and Neo Brokers Namibia (the Counterparty).

Available Trading Assets At Alpha Markets

No specific information is given about the assets on the Alpha Markets website until you log in to register with the broker.

Here are available trading assets offered by Alpha Markets:

CFDs

- Alpha Markets provides customers with various Contracts for Difference (CFDs).

- CFDs are financial instruments that enable traders to speculate on the price movements of underlying assets without owning them.

- Stock CFDs are among the offerings at Alpha Markets, allowing investors to trade on the price movements of individual company shares.

- Alpha Markets offers commodity CFDs, exposing the price fluctuations of commodities such as crude oil or natural gas.

Equity Indices

- Alpha Markets grants traders access to equity indices, allowing speculation on the performance of global stock market indexes.

- Equity indices represent the overall value of a particular stock market or sector and consist of a collection of stocks.

- Examples of equity indices available through Alpha Markets comprise the S&P 500, FTSE 100, and Nikkei 225.

- Investors can leverage these indices to take positions on the overall direction of markets without engaging in individual stock trading.

Precious Metals

- Alpha Markets facilitates trader involvement in the precious metals market, covering well-known metals such as gold, silver, platinum, and palladium.

- Through its platform, Alpha Markets broker provides trading opportunities in precious metals, allowing investors to take positions based on the price movements of these commodities.

- Investors can capitalise on potential price fluctuations in precious metals without the necessity of physically owning or storing the metals themselves.

- Alpha Markets empowers traders to benefit from the dynamics of the precious metals market in a convenient and accessible manner.

Energies

- Alpha Markets broker offers trading possibilities in diverse energy markets and commodities such as crude oil, natural gas, and other energy-related products.

- Traders can utilise these instruments to speculate on the price fluctuations of energy commodities, potentially profiting from shifts in global supply and demand dynamics.

- Alpha Markets brokers allow individuals to trade energy through its platform without needing physical ownership or storage of these commodities.

- Alpha Markets serves as a platform for traders to actively participate in the energy market, providing a convenient and accessible avenue for navigating the complexities of energy commodity trading.

Trading platforms offered by Alpha Markets

Alpha Markets offers the most advanced trading platform, MetaTrader5. Access MT4, MT5 cTrader with Trade245.

- MT5 offers traders access to extensive financial instruments spanning diverse markets.

- The platform has advanced charting tools, technical indicators, and efficient order execution capabilities.

- Traders can leverage up to 1:500 on all account types, potentially amplifying trading positions.

- Known for its user-friendly interface, MT5 provides customisable features and seamless integration with automated trading systems.

Account Types Offered by Alpha Markets

Alpha Markets prefers four types of accounts according to the needs and wants of the traders.

| Account Types | Minimum Deposit | Commission | Spreads | Leverage | Platform | Bonus |

| Classic | $5 | 0 | From 1 pip | 1:500 | MT5 | 0 |

| RAW Spread | $9 | $10 per lot | From 0 pip | 1:500 | MT5 | 0 |

| Alpha100 | $5 | 0 | From 0 pip | 1:500 | MT5 | 100% |

| Alpha Micro | $5 | 0 | From 0 pip | 1:500 | MT5 | 0 |

Alpha Markets Demo Account

Alpha Markets offers a Demo Account to the traders to try and trade on the platform.

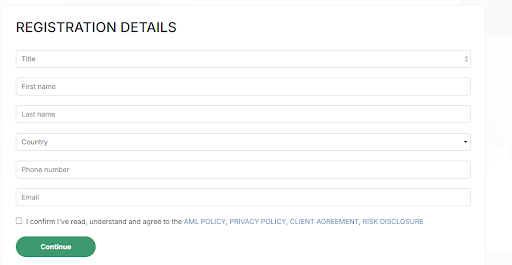

How To Open An Account On Alpha Markets

STEP 1: Click “Register Now” on the Alpha Markets website.

STEP 2: Enter the details required.

STEP 3: Click on Continue

STEP 4: Look for a confirmation PIN from Alpha Markets in your email.

STEP 5: Input the received PIN into the specified field on the registration page.

STEP 6: After entering the PIN, proceed with the registration process to finalise the account opening procedure.

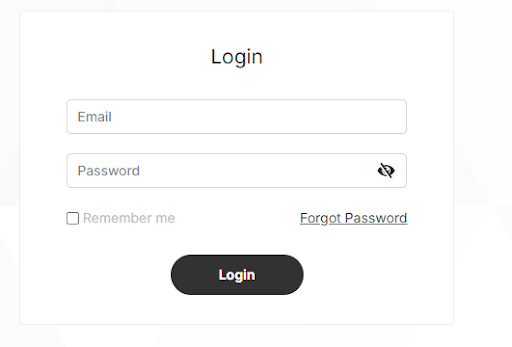

Alpha Markets Log In

After registering on the website, you can log in to Alpha Markets by entering your email and password.

Spreads, Fees and Commission

Alpha Markets offers traders competitive spreads, commencing at 0.0 pips. The brokerage provides multiple account types, each with distinct commission structures. The Classic Account does not involve commissions, whereas the Raw Spread Account incurs a $10 commission per standard lot traded. For high commissions, look for FXCM.

Alpha Market’s minimum deposits stand at $5.

Leverage

The maximum leverage offered by Alpha Markets is 1:500.

Deposits and Withdrawals

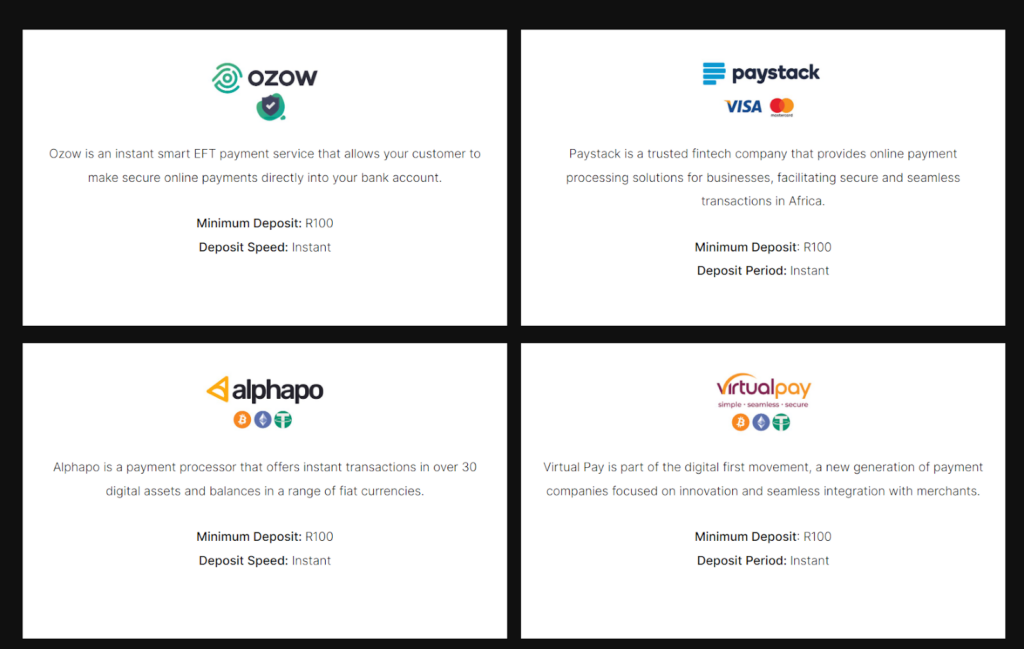

Deposits

The minimum deposit at Alpha Markets is $5 or R100, and for RAW Spread, it is $9. Alpha Markets offers various deposit options for traders, such as:

- Ozow

- Paystack

- Visa

- Alphapo

- Virtual Pay

All the deposits are instantly processed.

Withdrawals

There is no specific information about withdrawals on the website. For a clear withdrawal policy, look for Equiity.

Customer Support

Alpha Markets offers customer support services to aid their clients. To make inquiries or seek assistance, customers can

Phone number: +27 12 980 0035 or via

Email: [email protected] and [email protected].

Physical Address: Building B, 169 Corobay Ave, Menlyn, Pretoria, 0181

In addition, customers can engage with Alpha Markets on various social media platforms, including Facebook, Instagram, and TikTok. By providing multiple communication channels, Alpha Markets ensures customers have convenient ways to connect with their support team and address any concerns or questions.

Conclusion

Jason Noah founded Alpha Markets as a prominent online Forex broker. Since its inception, Alpha Markets has evolved into a robust and globally recognised investment firm, earning its status as an industry leader. The company provides a diverse range of platforms equipped with state-of-the-art technologies and pioneering training programs, aiming to empower aspiring traders and enable them to reach their full potential.