RCG Markets is a distinctive South African-based trading platform offering direct market access. Specialising in Forex and CFD trading, it boasts various instruments—Forex, Indices, Shares, Metals, Energies, and Commodities. Backed by cutting-edge technology, the broker provides a customer-centric experience with quick deposit and withdrawal options.

This RCG Markets Review evaluates if it is your ideal trading partner and the dos and don’ts to help you make an informed decision.

| BROKER’S NAME | RCG Markets |

| FOUNDED IN | 2018 |

| HEADQUARTERS | South Africa |

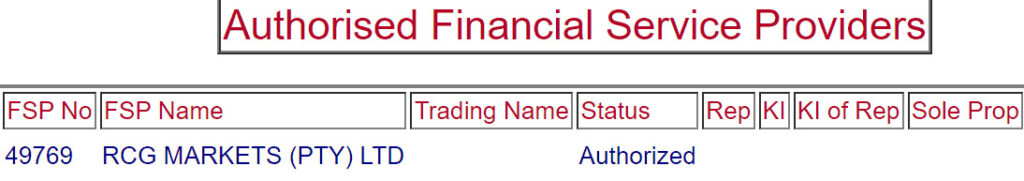

| REGULATORS | FSCA (Exceeded) |

| MINIMUM DEPOSIT | R50 |

| PLATFORMS OFFERED | MT4 |

| TRADING INSTRUMENTS | Forex, Indices, Shares, Commodities and Energies |

| ACCOUNT CURRENCY | GBP, ZAR and USD |

| MAXIMUM LEVERAGE | 1:2000 |

| CUSTOMER SUPPORT | 24/5 |

| DEPOSIT OPTIONS | Bank Transfer, B2BinPay, OZOW, Paystack, Skrill, Nettler, VirtualPay and Crypto |

| COMMISSION | $0 for other accounts, $7 for RCG ECN account |

| SPREADS | 0.0 PIPS |

| MOBILE TRADING | No |

| AFFILIATE PROGRAMME | No |

| CONTESTS AND BONUSES | Yes |

What is RCG Markets?

RCG Markets is a South African brokerage firm founded in 2018. The broker is regulated by the Financial Sector Conduct Authority (FSCA: FSP49769). RCG Markets distinguishes itself by offering remarkable features for traders. With an impressive leverage of up to 2000, the platform facilitates good trading experiences. Zero-commission accounts, competitive spreads, and low deposits make it a cost-effective choice.

The standout feature is direct market access, providing traders unparalleled control over their operations. RCG Markets emerges as a promising platform, combining high leverage, cost efficiency, and direct market access for a comprehensive and empowered trading experience.

Is RCG Markets a Fraudster?

No, RCG Markets is not a fraudster as it is regulated by the Financial Sector Conduct Authority (FSCA: FSP49769). Even though the broker holds a license, it is imperative to highlight that RCG Markets’ regulatory status should align with the standards set by prominent regulatory agencies.

This suggests that the broker may pose potential risks without robust legal oversight. In evaluating RCG Markets as a trading partner, understanding its regulatory framework becomes crucial in ensuring a secure and transparent trading environment.

Account Types Offered By RCG Markets

RCG Markets offered various account types for both Beginners and Experienced traders. The broker has recently added a new account type called Royal100.

| Account Types | Minimum Deposit | Spreads | Commissions | Bonus | Platform | Leverage |

| Classic Account | R50 | 1.5 pips | $0 | 0 | MT4 | 2000 |

| Raw Account | R50 | 0.0 pips | $0 | 0 | MT4 | 500 |

| ECN Account | R50 | 0.0 pips | $7 | 0 | MT4 | 1000 |

| ROYAL 100 | R50 | 1.5 pips | $0 | 100% | MT5 | 500 |

RCG Markets Demo Account

RCG Market provides complimentary demo accounts, an excellent opportunity for beginner traders to engage in risk-free practice. To access these demo accounts, search for RCG Markets demo accounts and visit the broker’s official website to complete the login process. Once there, input your details, choose the RCG demo classic account, and proceed with the registration.

This account has a brief validity period of 14 days, whereas many other brokers commonly provide demo accounts that remain accessible for a minimum of 30 days.

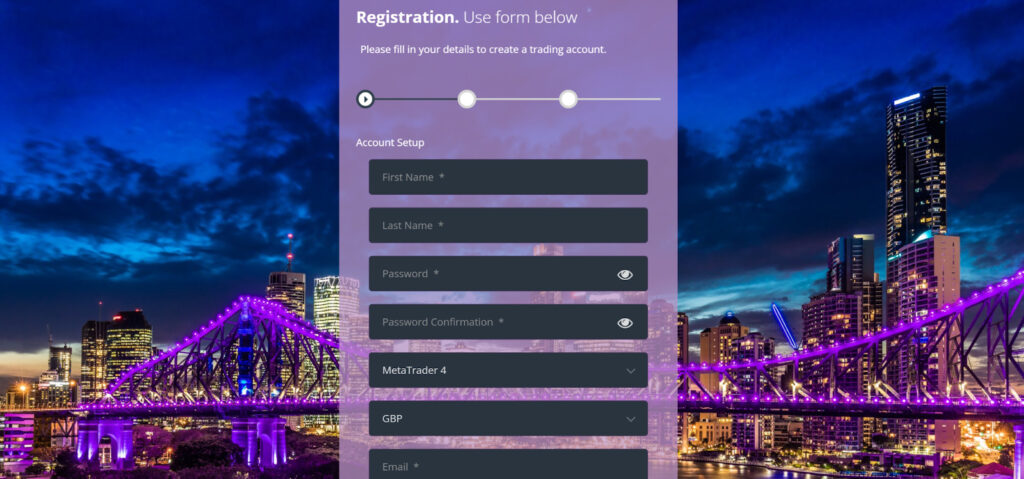

RCG Markets Registration Process

STEP 1. Choose the account type for your trading preference.

STEP 2. Provide your login credentials and complete the necessary information.

STEP 3. Fill out the required documents within the provided form.

STEP 4. Electronically sign in to your account.

STEP 5. Submit your completed account application.

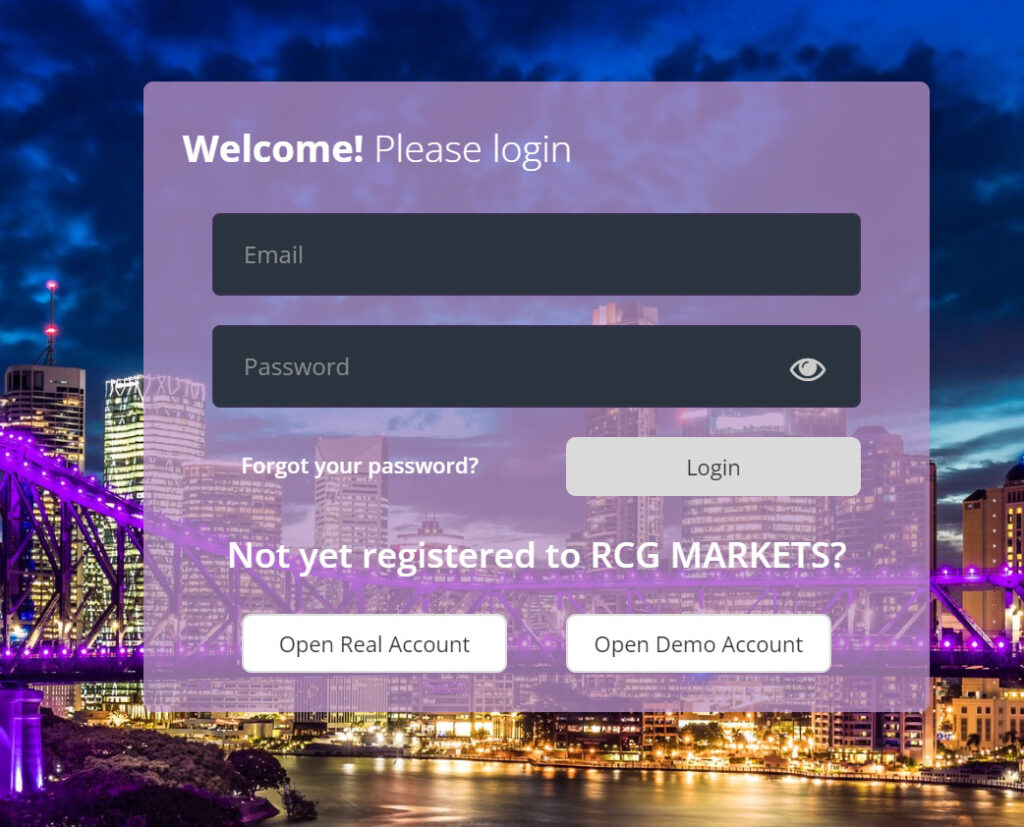

RCG Markets LogIn

You can log in to your RCG Markets account anytime after registering with the broker. The website offers two types of login: Client Login and and Partner Login. In Partner Login, the trader acts as an Introducing Broker or IB.

Platforms offered by RCG Markets

RCG Markets, while providing an MT4 trading platform, offers various other advanced trading platforms such as CQG, CTS, Vela, Itiviti, QST, OCS, and RCG Onyx Plus.

Assets Offered By RCG Markets

RCG Mrkets offers various types of assets to trade in. Here are these:

| METALS | AGRICULTURE COMMODITIES | SOFT COMMODITIES | FOREX | ENERGIES | FIXED INCOME | STOCK INDICES |

| Precious or Industrial metals | Cattle and hog futures | Food and Fibre Products | Various currency pairs | Crude Oil Futures | The oldest financial futures contract is the US Treasury Bond | US Stock market, select from broad indexes |

| Silver, Palladium, Gold, copper Platinum, and aluminium futures |

Corn, wheat, soybean, meat and Oil | Sugar, Coffee, Cocoa and Cotton | US Dollar, Euro, Pound Sterling, Japanese Yen | Heating oil and Gasoline | T-notes, EuroDollar Euribor |

DowJones NASDAQ S&P 500 |

Leverage

RCG Market offers a leverage range beginning at 1:500 for raw and royal accounts. Conversely, leverage can be accessed at up to 1:2000 for a classic account.

While RCG Markets provides substantial leverage, translating to heightened risks and potential losses, it’s advisable for novice traders to opt for an account with lower leverage.

Fees, Spreads, and Commission

RCG provide competitive spreads, ranging from 0.0 to 1.5 pips. Opting for an account with minimal spreads is advantageous, lowering operational costs and enhancing savings.

RCG Market requires only 50 African Rands to initiate trading with any offered account, and no commission charges are associated with trading on their platform. In contrast, FXSWay, another South African broker, imposes no deposit fees.

RCG Markets Deposits and Withdrawals

Deposits

RCG Markets’ minimum deposit stands at R50. The broker offers different types of deposit methods, such as:

- Bank Wire Transfer

- ACH Network (Automatic Clearing House),

- Cheques (only U.S. banking institutions accepted)

Regrettably, widely used payment methods such as E-wallets and credit/debit cards are not supported. Foreign cheques, money orders, Cash deposits, and similar payment methods are not accepted. Equiity provides diverse deposit and withdrawal options, each specified for user convenience.

Withdrawals

- The withdrawal request cutoff is at 17:00 GMT.

- The minimum withdrawal amount is R100.

- No extra fees are applied to deposits or withdrawals.

RCG Markets Review: Pros and Cons

Here are some pros and cons of RCG Markets:

| PROS | CONS |

| Range of Trading Instruments Offered | Regulatory license exceeded |

| Low Minimum Deposit | Limited Payment Options |

| Rich Educational and Research Resources | Islamic and Swap-free Account not available |

| Demo Account Available |

Customer Support

Multiple avenues, such as phone, email, and live chat, are available to connect with the customer service team. It’s essential to know that customer service operates during specific hours and is not always accessible.

Each client is provided with a dedicated account manager for personalised assistance. However, it’s important to highlight that there is no 24/7 customer support, and delays in response times have been reported when contacting the broker through calls or emails. For continuous and round-the-clock customer support, consider exploring Capitalix.

Address: RCG Markets, 13th Floor,

Green Park Corner, 3 Lower Road,

Sandown, Gauteng, 2196

Contact Number: +27 (10)0075974

WhatsApp Number: +27 82 401 6338

Email: [email protected]

[email protected]

[email protected]

Conclusion

Despite the abundance of features, RCG cannot be deemed a secure trading option due to its currently unclear regulatory status. Customer reviews on the broker platform have also been inconsistent. In light of these factors, exercising caution is advised.

We recommend refraining from trading with RCG Markets. Instead, consider exploring alternative options with comparable features, such as Mether World. If RCG is your preferred choice, it is advisable to wait until it regains regulatory status before engaging in trading activities.

FAQs

How old is RCG Markets?

RCG Markets was established in 2018.

What is the minimum deposit for RCG Markets?

The minimum deposit at RCG Markets is R50 or $5000.

What type of broker is RCG Markets?

RCG Markets is a financial service provider in South Africa which offers a range of trading assets.

What is the identity of the owner of RCG Market?

Michael McMillen serves as the CEO and Co-Founder of RCG Gambles LLC.

Is RCG Markets functioning as a global broker?

Indeed, RCG Markets operates as a global broker, extending its services across Africa and worldwide.