TradeEu Global, a formidable entrant in the online trading sphere, aims to redefine the trading experience for investors globally. This review aims to provide a thorough understanding of what makes TradeEU a notable option for traders looking for robust and innovative trading solutions.

It delves into TradeEu’s multifaceted aspects, from its regulatory framework to its diverse asset offerings and innovative technology.

| Broker | Tradeeu Global |

| Website | https://www.tradeeu.global/ |

| Registered Country | Mauritius |

| Founded In | 2024 |

| Regulation | Financial Services Commission |

| Trading Platforms | Metals, Indices, Forex, Cryptocurrencies,, Stocks, Commodities |

| Minimum Deposit | $250 |

| Maximum Leverage | 1:200 |

| Spreads | Starting from 0.01 Pips |

| Virtual Account | Yes |

| Islamic Account | Yes |

| Payment Methods | Maestro, Visa, Mastercard, SEPA, Gpay, |

| Customer Support | 14:00 – 23:00 GMT / Monday – Friday |

What is TradeEU Global?

TradeEU Global is an emerging online platform that aims to enhance the trading experience for investors around the world. It offers a comprehensive range of Financial assets, leveraging advanced technology to ensure a seamless and secure trading environment. The platform is noted for robust regulatory adherence, providing a trustworthy setting for trading activities. TradeEU Global caters to novice and experienced traders with its user-friendly interface and extensive educational resources, aiming to equip its users with all the tools necessary for successful trading.

TradeEU Global, regulated by FSC, emphasizes its dedication to transparency and accountability, enhancing user trust in the secure international trading environment. The platform offers a diverse array of assets, including metals, cryptocurrencies, commodities, forex, and indices. TradeEU Global utilizes the trading view as its primary platform to facilitate trading.

Is TradeEU Global a Scam?

Based on its regulatory compliance, the trading platform appears to be a legitimate broker. It is regulated by the Mauritius Financial Service Commission and operates under a valid license, offering reassurance about its legitimacy.

The broker is part of Tradesence Holding LTD, which is registered in Mauritius and Cyprus, indicating a structured corporate setup. However, given that TradeEU Global is relatively new in the market, traders should proceed with caution and conduct thorough research before engaging in trading activities.

Account Types Offered By TradeEU

TradeEU offers a variety of account types to cater to traders’ diverse needs. These accounts vary by minimum deposit requirements, service, and tools available, ensuring there’s a suitable option for everyone, from beginners to experienced traders.

| Account Type | Minimum Deposit | Features |

| Basic | $100 | Access to educational resources, standard spreads |

| Silver | $1000 | Includes basic features plus lower spreads |

| Gold | $10,000 | Includes silver features plus a personal account manager |

| Platinum | $50,000 | Includes gold features plus VIP customer service access to exclusive assets. |

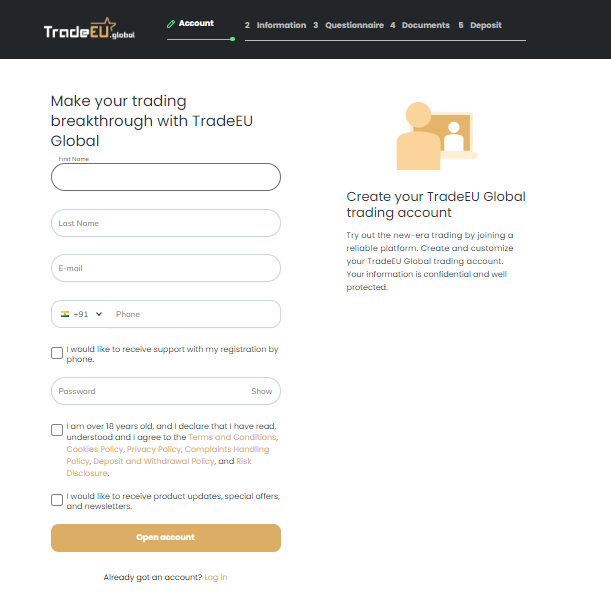

How to open an Account on TradeEU Global?

Step 1: Go to the TradeEU Global website and click the “Open Account” link in the upper right corner.

Step 2: Fill out the registration form with the required information and agree to the terms and conditions.

Step 3: Check your email for a confirmation message from TradeEU Global, and then follow the instructions to upload the necessary papers.

Step 4: Once your documents have been validated, you will be ready to begin trading.

Login at TradeEU

You can log in at TradeEU by entering the Email Id and Password.

Asset Offered by TradeEU

TradeEU provides a diverse range of trading assets, each with tailored leverage options to suit various trading strategies. This includes Forex with up to 1: 200 leverage, Indices, Metals, and Commodities, each offering up to 1: 50 leverage.

Shares and ETFs have more conservative leverage options of 1:10. The platform also offers Cryptocurrencies, although the specific leverage details for these are not specified. This array of assets with flexible leverage allows traders to diversify their portfolios and manage their risk exposure effectively.

If you want to check other forex brokers with the same asset options, you can opt for Equiity or Capitalix.

TradeEU Global Mobile Application

TradeEU offers a seamless trading solution for both iOS and Android Users. The iOS app for iPhone and iPad provides a user-friendly interface with robust security features, allowing traders to manage their activities conveniently from home or on the go.

Similarly, the Android app offers full control over your trading journey, ensuring that you never miss an opportunity, it also includes functionality for market notifications, keeping you updated with the latest news wherever you are.

TradeEU Global Pros and Cons

| Pros | Cons |

| Regulated by the FSC, ensuring reliability | Relatively new in the market |

| Offers a wide range of trading assets | May require new documentation for compliance |

| Advanced security features like two-factor authentication | |

| 24/7 customer support and educational resources |

Deposits and Withdrawals

TradeEU offers a range of payment methods for both deposits and withdrawals, ensuring flexibility and convenience for users. The platform supports major credit and debit cards and popular e-wallets like Skrill and Neteller. Users can also use bank transfers and open bank transfers.

All payment methods have no associated fees for deposits or withdrawals, making financial transactions cost-effective. The platform supports transactions in Euros and enhances accessibility for European traders.

TradeEU Global provides a streamlined process for both deposits and withdrawals, enhancing the trading experience for its users. Here’s a breakdown:

Deposits:

Access: Users can log into their accounts and navigate to the ‘Deposit’ section within the dashboard.

Methods: Various payment methods, including major credit cards and digital payment systems, are supported.

Procedure: Users select their preferred method, enter the deposit amount, and follow the on-screen instructions to complete the transaction.

Withdrawals:

Process: Similar to deposits, users access the ‘Withdraw’ section to initiate a withdrawal.

Options: The platform allows withdrawals through the same diverse payment options.

Timeline: Withdrawals typically take up to 3 business days to process, with additional time depending on the bank and payment method.

Currencies:

Flexibility: TradeEU supports EURO and US Dollars transactions, accommodating a global client base.

Fees, Spreads and Commission

The minimum account required to trade with the broker is $250. The broker does not charge any fees on depositing or withdrawing your funds, though some banks or payment methods might charge some fees. There is no mention of a commission on the TradeEU Global website.

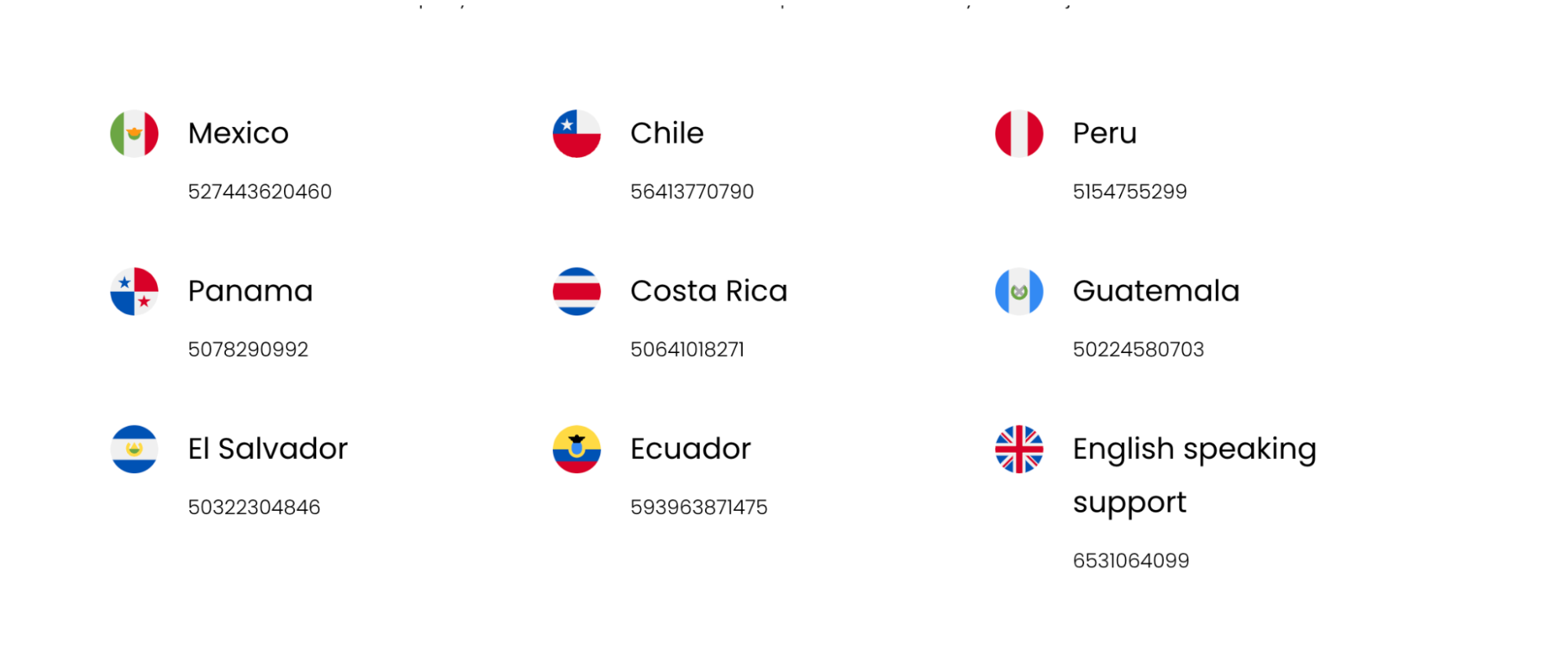

Technical assistance: Customer Support

TradeEU Global is committed to providing exceptional customer support to enhance the technical assistance and user experience. The customer support team is available Monday through Friday from 14:00 to 23:00 GMT and is equipped to assist in multiple languages, ensuring comprehensive support for a diverse customer base.

Users can reach out via dedicated phone lines available for several countries, reflecting TradeEU Global’s commitment to accessible and responsive customer service. This level of support underscores their dedication to user satisfaction and operational excellence.

Live chat is also available; to proceed with it, you have to fill out the sheet.

Conclusion:

TradeEU Global emerges as a promises platform for online trading, equipped with robust regulatory compliance and a wide array of trading assets. With user-friendly interfaces suitable for both beginners and experienced traders, the platform ensures a secure and efficient trading experience.

The lack of fees on transactions and the provision of educational resources and customer support enhance is appeal. However, potential traders should proceed with caution due to its relative newness in the market and thoroughly research before committing funds.