What Is MiTrade?

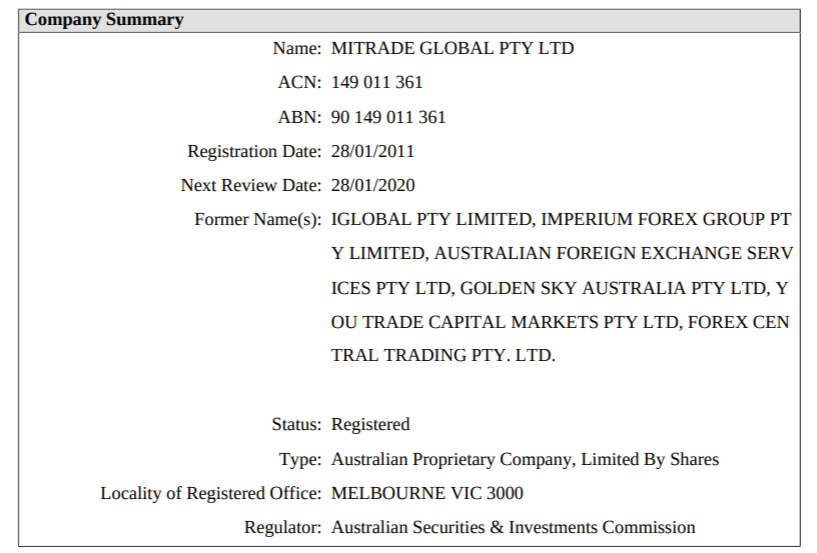

Mitrade Global Pty Ltd, headquartered in Melbourne, Australia, functions as an online broker specializing in forex and CFD trading. The company operates under the regulatory oversight of the Australian Securities and Investments Commission (ASIC) (AFSL 398528), the Cayman Islands Monetary Authority (CIMA) (1612446), and the Mauritius Financial Services Commission (FSC) (GB20025791).

Their online brokerage offers a wide range of financial instruments, including forex, commodities, major indices, and cryptocurrencies, totalling more than 300 options.

The development of their custom trading platform is the result of years of dedicated innovation and hard work by an international team of developers. This platform boasts a user-friendly and streamlined interface aimed at simplifying the trading experience for both novice and seasoned traders.

| FOUNDED IN | 1992 |

| HEADQUARTERS | Melbourne, Australia |

| REGULATORS | ASIC |

| MINIMUM DEPOSIT | $50 USD |

| PLATFORMS OFFERED | MiTrade’s own Web-based platform and Mobile platform |

| TRADING INSTRUMENTS | 60 currency pairs, Commodities, 11 indices, Cryptocurrencies and CFDs |

| ACCOUNT CURRENCY | EUR, USD, GBP, AUD |

| MAXIMUM LEVERAGE | 1:200 |

| CUSTOMER SUPPORT | 24*7 |

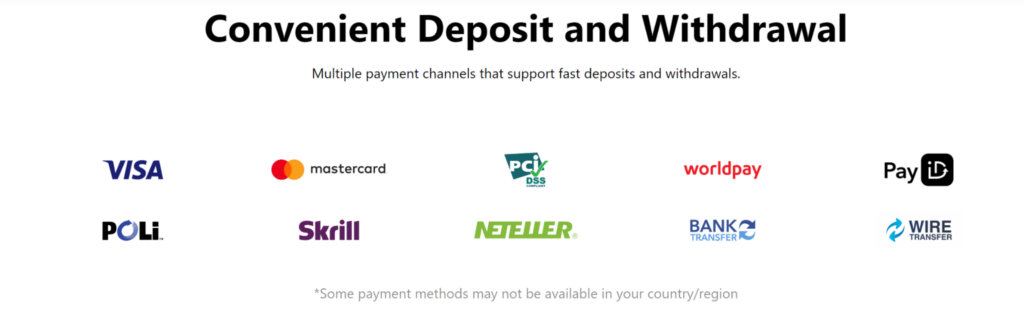

| DEPOSIT OPTIONS | Skrill, Poli, Mastercard, Visa, and Wire Transfer, Moneybookers |

| COMMISSION | No |

| SPREADS | Floating spreads |

| MOBILE TRADING | MiTrade Mobile App |

| AFFILIATE PROGRAMME | Yes |

| CONTESTS AND BONUSES | No |

We Recommend MiTrade For?

Although there might be thousands of other reviews over the internet applauding MiTrade, we feel there is one downside of MiTrade, and that is the type of account offered by the broker.

It only offers a standard account which we think might not be suitable for novice traders.

MiTrade provides a Demo Account as well, which has a validity period of 90 days, but it can become a permanent feature if you choose to create a live account.

After analysing such points, we would recommend a professional trader to trade with the broker.

Is MiTrade a Regulated Broker?

Indeed, MiTRADE is a regulated broker as it operates under the oversight of the Australian Securities and Investments Commission. This regulatory authority is responsible for ensuring that MiTRADE adheres to essential standards and guidelines, thereby establishing a secure and transparent trading environment for its clientele.

ASIC’s regulatory framework serves to safeguard the interests of traders and foster equitable conduct within the financial sector. Through its ASIC regulation, MiTRADE underscores its dedication to upholding elevated levels of professionalism and compliance with regulatory mandates.

What Type of Account does MiTrade offer?

MiTrade presents two account choices: the Standard account and the Risk-Free Demo account. To establish a MiTrade Professional live trading account, a minimum deposit of $50 USD is mandatory.

MiTrade exclusively offers a single live trading account option; alternatives are not available. However, they do provide various sign-in options, including the use of your Facebook or Google account.

If you want brokers that offer several types of accounts, you can check out Tradeeu

| Account Type | Spread | Leverage | Minimum Deposit |

| Standard Account | 0.8 pips | 1:200 | $50 |

Demo Account

MiTrade offers a Demo Account to the clients, which has a validity period of 90 days, but it can be made permanent by creating a live account. It provides a $10,000 virtual fund.

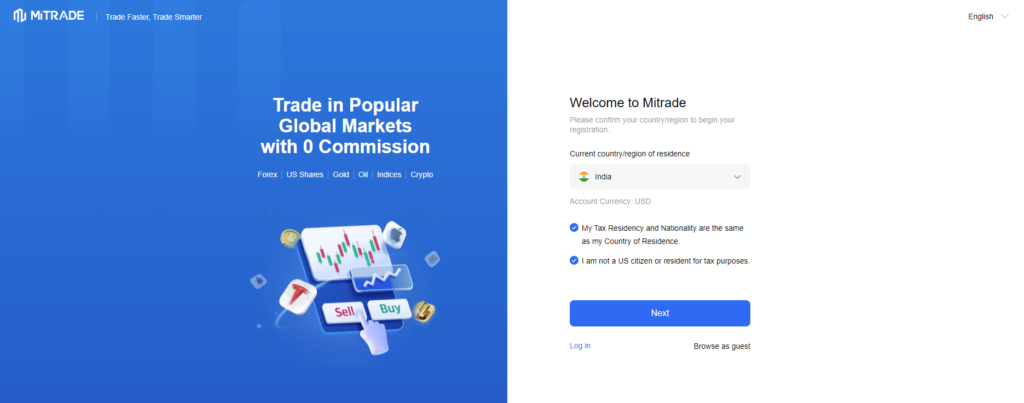

How to Open An Account On MiTrade?

STEP 1. Begin by choosing and clicking on the “Create Live Account” page.

STEP 2. Input the necessary personal information, including your name, email, phone number, and more.

STEP 3. Confirm the accuracy of your personal details by uploading the required documentation, such as proof of residence and identification.

STEP 4. Successfully conclude the electronic quiz to validate your trading expertise.

STEP 5. After your account has been activated and verified, proceed with making a deposit.

Deposits and Withdrawals of Mitrade

Deposits

Deposits with MiTrade are swift, with no associated fees for both deposits and withdrawals. There is no minimum deposit amount requirement, and traders have the flexibility to choose from multiple account-based currencies.

Withdrawals

Mitrade facilitates withdrawals via various methods, including Bank Wire, Credit/Debit Cards, and alternative channels. It has been determined that withdrawal processing times typically range from 3 to 5 business days when using Bank Cards and 3 business days when utilizing Bank Accounts.

Steps to Withdraw Funds from MiTrade

Step 1. Access your account by logging in.

Step 2. Navigate to the menu tab and select “Withdraw Funds.”

Step 3. Input the desired withdrawal amount.

Step 4. Pick your preferred withdrawal method.

Step 5. Fulfil the electronic request by providing the necessary information.

Step 6. Verify the withdrawal details and then submit your request.

Step 7. Monitor the current status of your withdrawal directly from your Dashboard.

Leverage

Mitrade’s leverage offerings are in strict adherence to the regulations imposed by ASIC, FSC, and CIMA:

- Australian clients holding ASIC-regulated Fusion Markets accounts can access leverage up to 1:30.

- For FSC (Mauritius) clients, the maximum available leverage is 1:30.

- CIMA (Cayman Islands) clients are provided with the option to leverage up to 1:200 for major currency pairs.

Fees and Commissions

Mitrade functions as a commission-free platform, meaning that the fees are primarily determined by the spread and the specific type of account you choose. We found out that Mitrade provides competitive trading fees and does not charge any kind of deposit or withdrawal charges.

It’s essential to be aware that if your position remains open for over a day, overnight fees will apply. Furthermore, accounts that have been inactive for 180 days will incur an inactivity fee of $10.

Pros and Cons of MiTrade

| PROS | CONS |

| Fully Digital Sign-up of Demo Account | There are no welcome bonuses, deposit bonuses, or any other broker-related incentives offered when signing up for the first time. |

| 24*7 Customer Support | Only one type of Account is offered. |

| Offers Educational and Research Tools | No Islamic or Swap-free account is offered. |

| Tight Spreads | Popular Trading platforms not offered, such as MT4 or MT5 |

| Commission Free Trading |

MiTrade Market Instruments

Mitrade presents a diverse range of more than 400 financial products encompassing Forex, Crypto CFDs, Commodities, Stocks, Indices, and Shares trading. It’s important to note that certain trading instruments may be exclusively accessible through CFDs or derivative products.

Among these offerings, Forex, the most sought-after asset class, is accessible for trading 24/5, featuring an average EUR/USD spread of just 0.12 pips.

Trading Platforms

Unlike other brokers, MiTrade offers its own created Mobile app and web platform rather than providing MT4 or MT5 trading platforms.

MiTrade Mobile App

- Traders can engage in trading numerous dynamic markets at their fingertips.

- One can stay updated on live market trends, access real-time trading analysis, and review the latest economic news.

- Traders can also enjoy the convenience of using various types of charts while on the move, with the capability to apply drawings without disrupting their trading activities.

- Traders can experience an award-winning trading platform meticulously designed for optimal performance on both Android and iOS devices.

WebTrader

- Traders can trade online directly from the PC browser, eliminating the need for any downloads.

- Broker offers a robust set of technical indicators to enhance trading strategies.

- Traders can access an array of risk management tools, including stop loss and negative balance protection, to effectively mitigate potential risks associated with their trades.

- They can benefit from intraday, short-term, and middle-term trading analyses, providing valuable insights to support your trading decisions.

Educational and Research Resources

MiTrade has a different section for Educational Resources that offers a comprehensive array of articles covering fundamental topics in forex and CFD trading. This includes guidance on effective trading techniques and risk management strategies.

These educational resources hold significance for traders at all levels of experience, serving as valuable tools to enhance their trading skills and knowledge.

-

Trading Basics

Here, beginners can learn the basics of trading and more.

-

Insights

Here, Traders can get insights into what is happening in the world of forex.

-

Academy

Free online courses for traders interested in forex to learn efficiently.

User Experience

MiTrade’s platform registration is simple and intuitive, with an interface designed for easy comprehension, even for individuals with minimal trading expertise. The top bar offers convenient access to a range of trading services, ensuring users can readily access them. The overall user experience is seamless, making this platform beginner-friendly for trading.

Customer Service

MiTRADE offers round-the-clock customer support led by a dedicated team of professionals. You can get in touch with them through email at [email protected]. Alternatively, you can complete the ‘contact us’ form on the broker’s website, and a customer support specialist will promptly assist you.

MiTRADE is also active on various social media platforms, including Instagram, Facebook, Twitter, YouTube, and LinkedIn. What we really think the broker lacks is its contact number on the website. Apart from this, the assistance by the broker is optimal.

For those who prefer in-person interaction, traders have the option to visit their offices at the following locations:

Mitrade Holding Ltd: 215-245 N Church Street, 2nd Floor, White Hall House, George Town, Grand Cayman, Cayman Islands.

Mitrade Global Pty Ltd: Level 13, 350 Queen Street, Melbourne, VIC 3000, Australia.

Mitrade International Ltd: Suite 707 & 708, 7th Floor, St James Court, St Dennis Street, Port Louis, Mauritius.

For better customer assistance, you can try Equiity

Conclusion

MiTRADE presents both positive and negative aspects. On a positive note, the broker holds regulation from ASIC, which provides a sense of trust and security among traders. Their various options of tradable assets and services, including forex, indices, shares, and commodities, lead to a wide spectrum of trading preferences. The demo account affords users the opportunity to hone their trading strategies without putting actual capital at risk.

With positive aspects come the negative ones too. MiTRADE’s trading platform is perceived as lacking in robustness. The platform potentially limits the availability of advanced features and tools for traders. There’s a lack of comprehensive information regarding leverage and minimum deposit requirements, leading to uncertainty for prospective clients.

Traders should also take into account the overnight fees imposed by the broker, as these can impact overall trading costs. Finally, the absence of 24/7 customer support may pose a challenge for traders in need of immediate assistance outside of regular business hours.