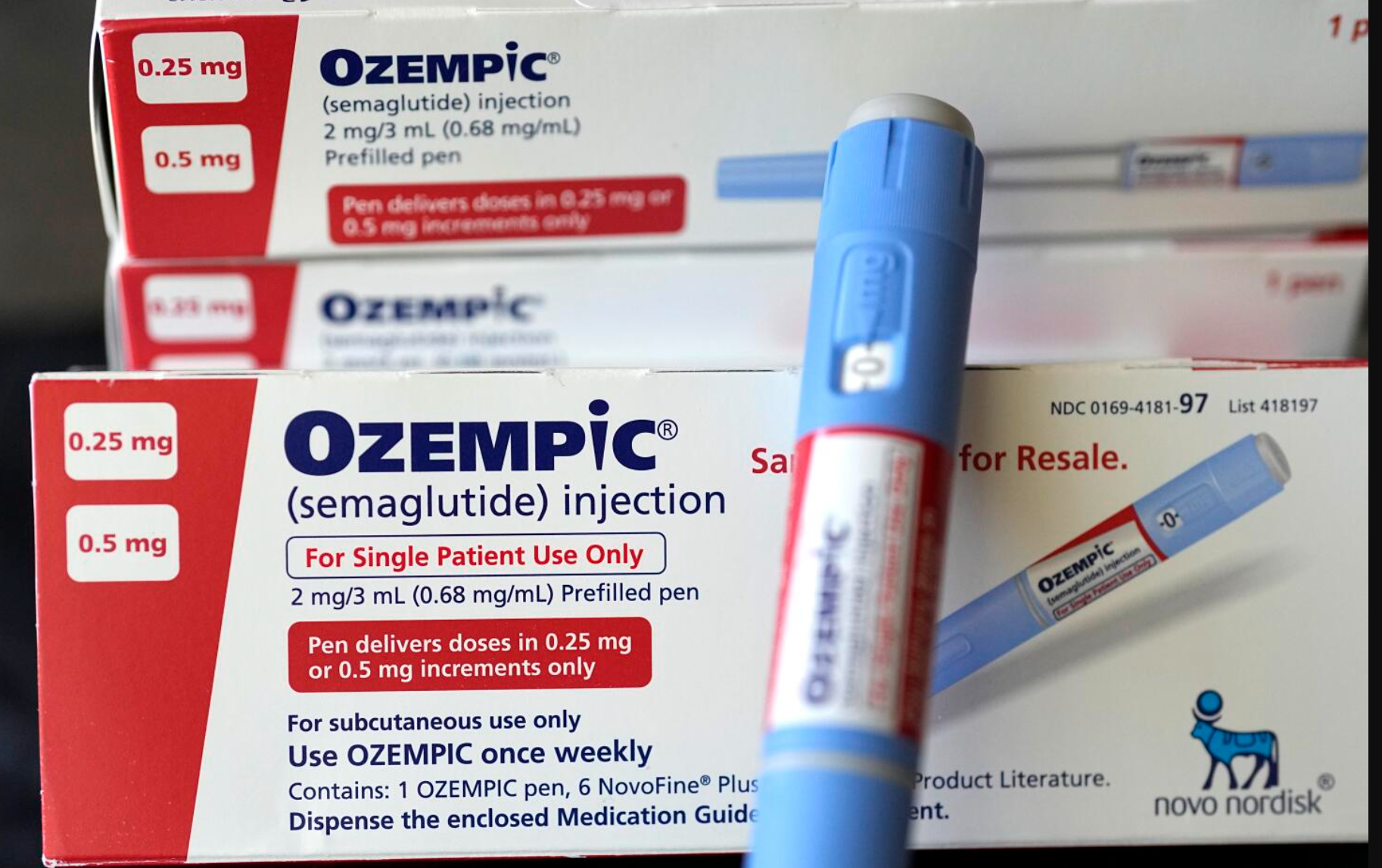

Ozempic, developed by Novo Nordisk, has become a significant player in the management of Type 2 diabetes, offering a novel approach to controlling this widespread condition. Its active ingredient, semaglutide, effectively reduces blood sugar levels and promotes weight loss, making it a dual-purpose medication. For insurance brokers and healthcare providers, understanding Ozempic’s benefits and limitations is crucial in advising clients on healthcare plans and coverage options. With its increasing popularity, Ozempic has influenced the healthcare market, leading to discussions about cost, accessibility, and insurance policy adjustments. Brokers play a vital role in navigating these changes, ensuring clients receive the best possible care within their healthcare plans.

The Role of Brokers in Educating Clients on Ozempic

Brokers are often the bridge between healthcare providers and clients, offering insights into the latest treatments and how they align with different insurance policies. With Ozempic’s rise, brokers have a responsibility to provide accurate information on its efficacy, potential side effects, and overall benefits. Educating clients on how Ozempic can be integrated into their healthcare regimen, alongside lifestyle modifications, is essential. This education should also extend to the financial aspects, including insurance coverage, out-of-pocket costs, and potential savings. By staying informed, brokers can help clients make well-rounded decisions about their diabetes management.

Ozempic’s Financial Implications for Healthcare Plans

The introduction of Ozempic https://laurel-foundation.org/how-to-get-ozempic-for-weight-loss/ into the market has financial implications for healthcare plans and insurance policies. Given its effectiveness and the potential for reducing long-term diabetes-related complications, Ozempic might be seen as a cost-effective option in the long run. However, its higher upfront cost compared to traditional diabetes medications may necessitate adjustments in healthcare plans and insurance coverage. Brokers must work closely with insurance providers to understand these changes and advocate for policies that consider the long-term benefits of medications like Ozempic. This involves negotiating coverage terms that make such treatments accessible without imposing financial burdens on clients.

Navigating Insurance Coverage for Ozempic

One of the key challenges brokers face is navigating the complex landscape of insurance coverage for new medications like Ozempic. With each insurance provider offering different coverage terms, brokers must diligently compare plans to identify those that best meet their clients’ healthcare and financial needs. This may involve advocating for broader coverage of Ozempic or seeking out supplemental insurance options. It’s also important for brokers to stay abreast of any changes in insurance policies regarding diabetes management and medication coverage. Effective communication with both insurance companies and clients is essential for ensuring that individuals have access to Ozempic under their current plans.

Looking Ahead: Ozempic and the Future of Diabetes Care

As research into Ozempic continues, its role in diabetes care is likely to expand, potentially offering new benefits and applications. For brokers, this means staying informed about the latest developments and how they might affect insurance coverage and healthcare planning. The ongoing evolution of Ozempic’s use could lead to broader insurance coverage, more competitive healthcare plans, and an increased focus on comprehensive diabetes management. By keeping their finger on the pulse, brokers can provide clients with the most current and beneficial advice, helping them navigate their healthcare options in an ever-changing landscape.

In conclusion, Ozempic represents a significant advancement in diabetes treatment, with implications for healthcare management, insurance coverage, and patient outcomes. For brokers, it offers both challenges and opportunities to enhance their service offerings, ensuring clients have access to innovative treatments within their healthcare plans. As the landscape evolves, brokers’ role in advising on and advocating for effective diabetes management strategies becomes increasingly important.